CONTINUOUS DISCLOSURE

Continuous disclosure obligations require Unity Mining Limited (the Company) to keep the market fully informed of information which may have a material effect on the price or value of the Company’s securities (material information) and to correct any material mistake or misinformation in the market. The Company discharges these obligations by releasing information to ASX along with providing timely information to investors, and the market generally via the means such as the Company’s website, broadcast emails or media releases.

This document sets out the policy and procedures adopted by the Board of the Company in order to comply with their continuous disclosure obligations under the Corporations Act 2001 (particularly Sections 674 – 678) and ASX Listing Rules (particularly Listing Rule 3.1).

Consequences of Failure to Comply with Continuous Disclosure Obligations

If the Company contravenes its continuous disclosure obligations required by Listing Rule 3.1 by failing to notify ASX of material information (“information”):

- that is not generally available; and

- that a reasonable person would expect, if it were generally available, to have a material effect on the price or value of securities issued by the Company;

it, and its officers, may be guilty of an offence under the Corporations Act 2001.

If the Company contravenes its continuous disclosure obligations, it may face criminal or civil liability, de-listing from ASX and proceedings by ASIC under the Australian Securities and Investments Commission Act 2001.

The Company’s officers (including its Directors), employees or advisers who are involved in a contravention by the Company, may also face criminal penalties and civil liability. The court also has power under the Corporations Act 2001 to order compliance with the Listing Rules on the application of ASX, ASIC or an aggrieved person (for example, a shareholder of the Company).

Contravention of its continuous disclosure obligations may also lead to unwanted publicity for the Company and may cause damage to its reputation in the marketplace which may adversely impact upon the market value of the Company’s securities.

1. Disclosure Principle

1.1 First Guiding Principle – immediate notice of material information

The Company must immediately notify the market via an announcement to ASX of “information” concerning the Company that a reasonable person would expect to have a material effect on the price or value of Company Securities.

1.2 Materiality Definition

Whether “information” is considered material, and therefore required to be disclosed will vary according to the circumstances, and is therefore a matter of qualitative and quantitative judgment.

Materiality is assessed qualitatively by assessing the “information” relative to the Company’s business activities, size and market capitalisation. Quantitative assessment is guided by AASB1031 which presumes that a transaction is deemed to be immaterial if it is equal to or less than 5% of the relevant base amount. The base amount can be any relevant number such as market capitalisation, share price, annual revenue or expenditure.

Section 677 of the Corporations Act provides that information is material if a reasonable person expects the information would, (or would be likely to), influence investors in deciding whether to buy, hold or sell Company Securities.

1.3 Exception to the First Guiding Principle

Disclosure is not required where:

-

- a reasonable person would not expect the information to be disclosed; and

- the information is confidential and the ASX has not formed the view that the information has ceased to be confidential; and

- one or more of the following applies:

-

-

-

- it would be a breach of the law to disclose the information;

- the information concerns an incomplete proposal or negotiation;

- the information comprises matters of supposition or is insufficiently definite;

- the information is a trade secret; or

- the information is generated for internal management purposes.

-

-

Each of the above three requirements must be satisfied for material information to be exempt from disclosure.

2. Internal Reporting Process

2.1 Reporting of Information

Employees must immediately inform Senior Management of:

- any potentially material price or value sensitive information or proposal; or

- a matter that meets the criteria in the materiality guidelines advised by the Company Secretary.

Employees must consult Senior Management if they are unsure whether a matter should, or needs to be disclosed. Examples of such “information” may include:

- positive exploration results;

- merger or takeover discussions;

- a change in the Company’s operating performance;

- a change in the Company’s operating assets (destruction, failure, natural disaster etc)

- a change in the Company’s financial forecast or expectation;

- the threat of major litigation against the Company;

- material information affecting joint venture partners or non wholly-owned subsidiaries

- a recommendation or declaration of a dividend or distribution;

- possible departure of key members of staff;

The Senior Management is to coordinate the provision of material or potential material information from their business unit to the Company Secretary.

Directors and Senior Management must immediately inform the Company Secretary if they become aware of information that:

- is not generally available (i.e. the information has not been included in any Annual Report, ASX Release or other publication from the Company); and

- which may be price sensitive (i.e. it is likely to have a financial or reputational impact upon the Company that may be considered material)

2.2 Market Disclosure Process

The Managing Director, with assistance from the Chief Financial Officer/Company Secretary and the Investor Relations Manager, will determine what information is considered ‘material’ (detailed in Section 1.2), and thus must be disclosed to the market in accordance with the Listing Rule requirements. The Company must not publically release information before it has been disclosed to ASX.

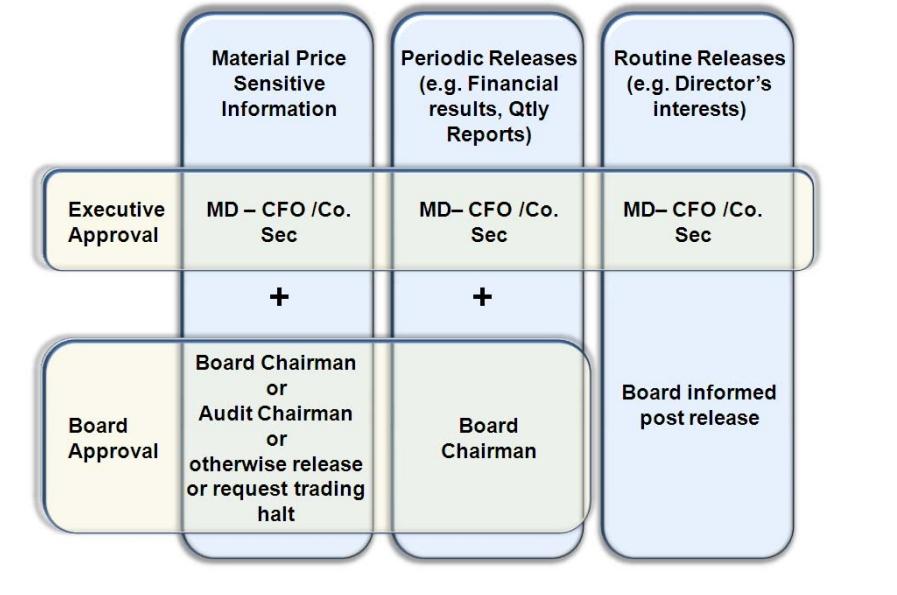

The disclosure process undergoes differing levels of internal control and approval prior to release to ASX depending on the nature and materiality of ‘information’. The range of information that the Company releases to ASX has been defined from extreme priority “Material Price Sensitive.

Information”, to high priority “Periodic Releases” to lower priority “Routine Releases”. The management of these information flows are outlined below and shown graphically in Annexure A.

2.2.1 Material Price Sensitive Information

The Company Secretary must immediately notify the ASX once he or she becomes aware of any Material Price Sensitive Information which does not fall within the exception to the first guiding principle.

The proposed ASX announcement regarding a matter of material significance to the Company (as determined by the Managing Director) must be approved by the Executive (Managing Director and Company Secretary) prior to referral to the Board Chairman, or if unavailable the Chair of the Audit & Remuneration Committee, or if unavailable any other Director, who will determine whether the full Board or relevant Board Committee is required to review the ‘information’ prior to disclosure to ASX.

Time is of the essence and if immediate market disclosure is not possible, then a trading halt will be requested by the Managing Director until such time as release to ASX of the ‘information’ сan be made (section 4.).

2.2.2 Periodic Releases

The Company is obliged to make periodic disclosures, such as quarterly operating reports, financial results, (Periodic Releases) pursuant to the ASX Listing Rules and Corporations Act. All Periodic Releases must be approved by both the Executive (Managing Director and Company Secretary) and the Board Chairman before release to ASX.

The approval procedure with Periodic Releases is driven by the content of information, and hence any Periodic Release which contains Material Price Sensitive Information is managed according to section 2.2.1.

2.2.3 Routine Releases

ASX announcements of an administrative nature, such as updates to Director’s Interests or submission of presentations to be delivered at conferences etc., will be approved by the Executive and released to ASX. The Board will receive confirmation of such releases once submitted to ASX.

2.3 Delivering Material Information

When the Company releases ‘information’ to ASX, it must:

- be made in a timely manner;

- be factual;

- not omit material information; and

- be expressed in a clear and objective manner that allow investors to assess the impact of the information when making investment decisions.

Once the Company Secretary has received acknowledgment from the ASX that an announcement made under section 2.4 of this policy has been released, The Company must promptly inform investors that the announcement has been made by posting a notice on the Company’s website.

The Executive may, where appropriate, approve additional methods for the dissemination of an announcement to the market. This may include issuing a press release, sending emails to media outlets or organising a mail-out to Company security holders.

2.4 ASX Announcements Checklist

The Company has created an ASX announcements checklist (CLT-02-03-02-C) to identify and record the necessary internal approvals required prior to release to ASX. This checklist also ensures that the necessary steps are taken to communicate ASX-approved releases to investors, media and employees as required. These signed documents are kept on file by the Company Secretary.

2.5 Timing

The Company must not release any information publicly that is required to be disclosed through the ASX until the Company Secretary has received formal confirmation of its release by the ASX. Where information is to be released in Melbourne (the Company’s registered office) and simultaneously in another market, the Investor Relations Manager must consult in advance with the Company Secretary to determine how the requirements of the ASX will impact the timing of the release.

2.6 Correcting and Updating Information

If the Company discovers that information disclosed to the market is, or has become materially incorrect due to subsequent information, the Company must release an announcement correcting or updating the relevant statement immediately following the discovery of the inaccuracy.

3. Market speculation, rumours and external communication

3.1 No comment policy for employees

The Company generally does not respond to market speculation or rumours unless required to do so by law. Whether a comment is to be made in response to market speculation or a rumour is a decision for the Executive.

It is recognised that all employees contribute to the Company’s goal of achieving full compliance with its continuous disclosure obligations under the Corporations Act and ASX Listing Rules. To assist the process, a ‘plain English’ guideline is available to all employees which explains the various issues relating to disclosure of material information and how best to handle them. (GLN-23- 12-01 “Guideline on responding to enquiries”).

3.2 Statements regarding market speculation and rumours

A statement in relation to market speculation or a rumour must be issued where:

- the Executive considers that the Company has an obligation at that time to make a statement to the market about a particular matter; or

- the Company is required to respond to a formal request for information from the ASX.

For example, a statement may be required to correct or prevent a false market (see Section 3.3). Statements in relation to market speculation or rumour are to be prepared by the Executive, and referred by the Managing Director to the Chairman, (or any other Director in the Chairman’s absence), who will determine whether the statement should be considered by the Board or relevant Board Committee.

3.3 Second guiding principle – false market

If ASX considers that there is or is likely to be a false market in Company Securities and asks the Company to give it information to correct or prevent a false market, the Company must give the ASX the information needed to correct or prevent the false market.

The obligation to give information under this rule arises even if the exception to the first guiding principle applies (the available exceptions no longer apply). There is no formal definition of “false market” however the ASX provides the following guidance on its meaning:

“Reasonably specific rumour or media comment in relation to the entity that has not been

confirmed or clarified by an announcement by the entity to the market and there is evidence that

the rumour or comment is having an impact on, or ASX forms the view is likely to impact, the price

of the entity’s securities.”

3.4 Authorised spokespersons

Information regarding the Company may only be disclosed to external parties, including the media, by spokespersons authorised by the Managing Director from time to time.

3.5 No embargo of information

Employees (including Directors) must not disclose information publicly, (eg to analysts or journalists), under an embargo arrangement in relation to any matter that is potentially the subject

of this policy.

4. Trading halts

It may be necessary to request a trading halt from the ASX to ensure that orderly trading in the Company’s Securities is maintained and to manage disclosure obligations.

No Employee other than the Managing Director or Chairman is authorised to seek a trading halt.

The process for seeking a trading halt is as follows:

- Upon the Executive determining that there is a need to request a Trading Halt, the Managing Director shall then brief the Chairman, if available. After briefing the Chairman, or if the Chairman is not available, the Managing Director is authorised to seek a trading halt;

- the Managing Director shall then advise the Board of the trading halt; and

- if the Managing Director is unavailable, the Chairman is authorised to seek a trading halt after receiving a recommendation to do so from the Company Secretary or the Investor Relations Manager and the Chairman shall then advise the Board of the trading halt.

5. Analyst/Media Briefings

Information provided to, and discussions with, analysts, media or other external parties are subject to this Continuous Disclosure Policy.

Material information must not be selectively disclosed (eg. to analysts or the media) prior to being announced to ASX. If a Director or Senior Manager is proposing to present any information to analysts, journalists or any other party, he/she should ensure that copies of the information are provided to the Company Secretary prior to presenting that information externally.

All inquiries from analysts must be referred to the Managing Director or Company Secretary. All material to be presented at an analyst briefing must be approved by or referred through the Managing Director or Company Secretary prior to briefing.

All inquiries from the media must be referred to the Managing Director or Company Secretary. All media releases must be approved by or referred through the Managing Director or Company Secretary prior to release to journalists.

All material to be presented (for example at seminars) must be approved by or referred through the Managing Director or Company Secretary prior to presentation.

Periods in which interviews may not be given or in which presentations may not be made without the specific permission of the Managing Director may be imposed. Relevant persons will be notified of any such interview/briefing black-out period.