QUARTERLY REPORT April – June 2001

Quarterly Report April – June 2001

Highlights

- Numerous high-grade drill intersections

- Above expectation Inferred Resource defined in the area tested to date

- Further advances in predicting the location of significant mineralisation within the New Bendigo

- Indication of very high gold recovery without the use of cyanide

- Progress with funding

In this document, the term “resource potential” is used to describe the Company’s estimate of the contained ounces of gold which it believes, on the basis of a technical evaluation of available data and geological extrapolation, should occur within the New Bendigo. It is emphasised that this term is not covered by the JORC Code and is not equivalent to a Mineral Resource or Ore Reserve estimate.

The information in this report that relates to Mineral Resources or Ore Reserves is based on, and accurately reflects, information compiled by G F Johansen, Member of the Australian Institute of Mining and Metallurgy. Mr Johansen is a full-time employee of the Company and has relevant experience in relation to the mineralisation being reported to qualify as a Competent Person as defined in the Australian Code for Reporting of Mineral Resources and Ore Reserves. Mr Johansen consents to the inclusion in the report of the matters based on the information in the form and context in which it appears.

EXPLORATION

Drilling Results

Drilling at New Bendigo recently intersected 2.4 metres of reef within the S3 ribbon containing 9 pieces of visible gold with an estimated grade of +100g/t Au. This is a continuation of the series of high grade intersections recorded at New Bendigo in drilling and are related to the presence of abundant coarse gold.

High-grade intersections recorded to date include:

Sheepshead

| Hole ID | From | To | Length (Metre) | Grade (g/t Au ) |

|---|---|---|---|---|

| NBD 031 | 363.5 | 377.0 | 13.5 | 58.1 |

| NBD 031 | 389.0 | 402.0 | 13.0 | 9.5 |

| NBD 031 W1 | 365.8 | 381.0 | 15.2 | 6.7 |

| NBD 041 W1 | 310.0 | 328.0 | 18.0 | 33.1 |

| NBD 041 W8 | 390.0 | 405.6 | 15.6 | 9.5 |

| NBD 044 W11 | 403.7 | 406.1 | 2.4 | +100* |

*Visual estimate of grade.

Deborah

| Hole ID | From | To | Lenght (Metre) | Grade(g/t Au) |

|---|---|---|---|---|

| NBD 028 W1 | 530.9 | 539.9 | 9.0 | 229.0 |

| NBD 033 | 259.0 | 269.2 | 10.2 | 32.2 |

| NBD 033 W4 | 273.0 | 283.0 | 10.0 | 10.1 |

| NBD 042 W1 | 378.0 | 381.0 | 3.0 | 237.1 |

Inferred Resource

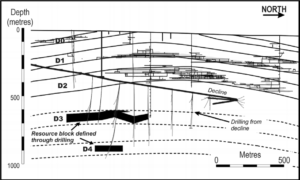

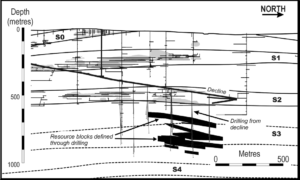

BMNL has previously estimated the resource potential of the New Bendigo Project as 12.3 million ounces, with the D3/D4 and S3/S4 ribbons estimated to contain a resource potential of 650,000 ounces of gold representing less than 5% of the total resource potential.

BMNL has completed in excess of 30,000 metres of diamond drilling from the Swan Decline into the D3/D4 and S3 ribbons and has estimated an Inferred Resource of 700,000 ounces.

| Tonnes | Grade | Ounces | |

|---|---|---|---|

| D3/D4/S3 | 1,800,00 | 12* | 700.000 |

*Best estimate grade within a grade range from 10 to 15 g/t Au.

The Inferred Resource estimated from the current drilling is above expectations as drilling to date has tested less than 50% of the combined strike length of the D3/D4 and S3/S4 ribbons.

The Inferred Resource is located within 12 separate bodies of gold-mineralised quartz reefs and stockwork zones which were not known to the old-timers, but the existence of which is consistent with BMNL’s “repeat ribbon” theory. Because of the challenges presented by the well-known and extreme nugget effect at Bendigo, BMNL has not attempted at this stage to assign a gold grade to individual reefs. There is currently insufficient sampling data to make such local grade estimates with a degree of confidence which would be appropriate to an Inferred Resource category. Instead BMNL has assigned a best-estimate global grade within a grade range based primarily on an assessment of all the Screened Fire Assay drilling results received to date. These results are backed up by knowledge of the geological characteristics of the mineralised zones and the gold grade of similar mineralisation mined in the past.

While the total Inferred Resource is comprised of 12 separate reefs, the actual grades of individual reefs are likely to vary considerably from the average grade of the total resources. Some of the reefs may be close to the current indicated cut-off grade of approximately 6g/t Au, and others, particularly those in the lower S3 and D4, are likely to substantially exceed the upper end of the global grade range. Closer spaced drilling and possibly in-ore sampling will be required to estimate grade for individual reefs.

Geological Advances

BMNL has made further progress in predicting the location of significant mineralisation within the New Bendigo. The company has identified a strong correlation between the size (and intensity) of hydrothermal alteration envelopes and the intensity of gold mineralisation within alteration envelopes. This, combined with the previously reported importance of bedding parallel laminated veins, significantly improves the success rate of exploration drilling.

The structurally important bedding parallel laminated veins create a strong stratigraphic control to ribbon location. Following the delineation of a stratigraphic sequence for the hosting sediments it was found all mineralisation intersected within the Sheepshead line of reef is part of the S3 ribbon with mineralisation extending for 150 metres up-dip from the major faults. The S4 ribbon is yet to be tested by drilling.

METALLURGY

Initial results from metallurgical test work

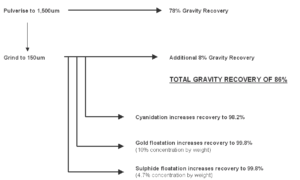

The results of preliminary metallurgical testing have also been positive with initial results indicating recoveries of 99%, with 85% recovery by simple gravity processing and an additional 14% from sulphide flotation. The preliminary testing was conducted on a sample grading 8.17g/t Au as shown in the flow diagram below.

In excess of 50 tonnes was processed to 1,500µ and subjected to gravity separation with a 50kg tailings sample dispatched to AMDEL for additional grinding, gravity, cyanidation and flotation testing. Comprehensive metallurgical testing is currently underway to confirm the preliminary results.

FUNDING

The Chairman and Managing Director of BMNL and the Managing Director (Investment Banking) of N M Rothschild & Sons (Australia) visited a select group of large multinational and local gold producers and specialist funds during May. Following on from this visit a number of interested parties are examining the technical detail of the project. Visits to the Company’s data room are planned to continue until early August.

Statement of Financial Performance For the quarter ended 30 June 2001 (Unaudited) $A’000

Operating Expenditure 2,912

Less: Interest Received (100)

Operating Loss 2,812

Income Tax Attributable 0 Operating Loss After Income Tax 2,812

Accumulated Losses 31/03/01 59,792

Accumulated Losses 30/06/01 62,604

Statement of Financial Position As at 30 June 2001 (Unaudited) $A’000

CURRENT ASSETS

Cash & Investments 7,110

Other Current Assets 1,122

TOTAL CURRENT ASSETS 8,232

NON CURRENT ASSETS

Property, Plant and Equipment 2,553

TOTAL NON CURRENT ASSETS 2,553

TOTAL ASSETS 10,785

CURRENT LIABILITIES

Accounts Payable 853

Interest-Bearing Liabilities *See note below 6,165

Provisions 138

TOTAL CURRENT LIABILITIES 7,156

NON CURRENT LIABILITIES

Provisions 16

TOTAL NON CURRENT LIABILITIES 16

TOTAL LIABILITIES 7,172

NET ASSETS 3,613

SHAREHOLDERS’ EQUITY

Share Capital 66,217

Accumulated Losses (62,604)

TOTAL SHAREHOLDERS’ EQUITY 3,613

Note: Redeemable convertible notes maturing on 24 October 2001 or as extended by agreement between the parties.

The redemption proceeds (including interest) must be applied to pay for new shares in the Company (Please refer to the announcement made on 24 April 2001 for the principal terms of the agreement).