QUARTERLY REPORT January – March 2002

Quarterly Report January – March 2002

Highlights

- Continued exploration drilling success:

- Strike continuity of reefs in S3 ribbon on Sheepshead line for 750 metres and open to north and south

- High grade reef identified on the Deborah line, 330 metres long and open to the south

- Decline development on target and within budget

Milestones

- April – June 2002 – Drill testing new ribbon position (S4) on Sheepshead line

- July – September 2002 – Re-estimation of Resource in S3, D3 and D4

- October – December 2002 – Reef access on Deborah line (D3) and Sheepshead line (S3 Upper) – On strike drill testing of D4

- January – June 2003 – Reef access Sheepshead Line, S3 Middle and S3 Lower

In this document, the term “resource potential” is used to describe the Company’s estimate of the contained ounces of gold which it believes, on the basis of a technical evaluation of available data and geological extrapolation, should occur within the New Bendigo. It is emphasised that this term is not covered by the JORC Code and is not equivalent to a Mineral Resource or Ore Reserve estimate.

The information in this report that relates to Mineral Resources or Ore Reserves is based on, and accurately reflects, information compiled by G F Johansen, Member of the Australian Institute of Mining and Metallurgy. Mr Johansen is a full-time employee of the Company and has relevant experience in relation to the mineralisation being reported to qualify as a Competent Person as defined in the Australian Code for Reporting of Mineral Resources and Ore Reserves. Mr Johansen consents to the inclusion in the report of the matters based on the information in the form and context in which it appears.

NEW BENDIGO GOLD PROJECT

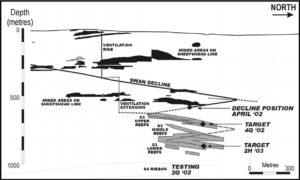

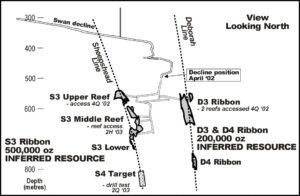

Bendigo Mining NL is well advanced in developing an underground mine on the New Bendigo resource potential of 12 million ounces. The initial focus is on two lines of reef, Sheepshead and Deborah, where drilling to date has defined 700,000 ounces of Inferred Resource in three ribbons, S3, D3 and D4. The planned exploration program for the next 18 months includes 1,600 metres of exploration drive development on 7 separate reefs in the S3 and D3 ribbons (5 reefs in S3 and 2 reefs in D3), 80 bulk samples and 2,500 metres of close spaced drilling for Resource and Reserve definition.

Underground access via decline tunnel into the first gold bearing reefs in the S3 ribbon (Upper) and D3 ribbon is on schedule for the fourth quarter of 2002 when detailed drilling, on-reef exploration drive development and bulk sampling will be undertaken in order to define Reserves and Resources. Decline development to the lower S3 reefs will continue into 2003.

The production start up decision is targeted for late 2003.

RESOURCE/RESERVE DEFINITION

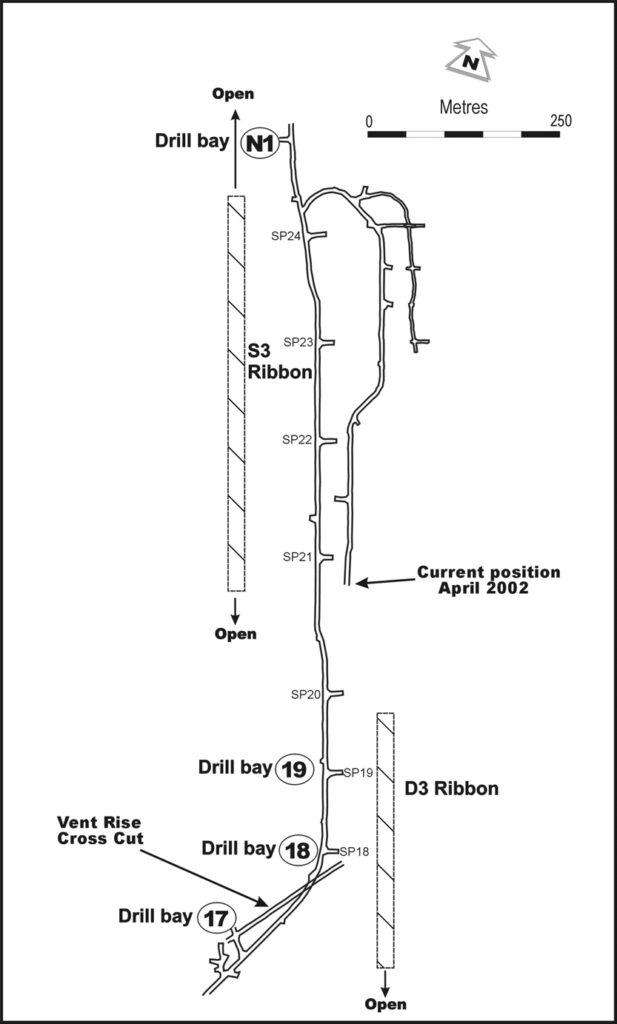

Sheepshead Line Evaluation

S3 Ribbon

The S3 ribbon comprises 9 gold bearing reefs with an Inferred Resource of 500,000 ounces.

During the quarter drill testing from drill bay N1 confirmed strike continuity of the reefs for a further 120 metres to the north. Reefs within the S3 ribbon extend for at least 750 metres and are open along strike to the north and south.

A re-estimation of the Inferred Resource is scheduled for completion in the third quarter of 2002.

The uppermost reef in S3 is targeted to be accessed for on-reef development and bulk sampling during the fourth quarter of 2002. Development of the decline will continue and is planned to reach the lowermost reefs in the S3 during the second half of 2003. A total of 5 gold bearing reefs will be accessed in S3 for exploration drive development, bulk sampling and detailed drilling.

S4 Ribbon

The S4 ribbon position is predicted to be some 200 metres beneath the S3. The first drill testing of this ribbon has commenced in April 2002.

Deborah Line Evaluation

D3 Ribbon

Drill testing of the D3 ribbon has identified a high grade reef on four sections over 335 metres of strike (from drill bays 17 to 19). The reef increases in width towards the north from an average of 1 metre to 4 metres. Significant drill intersections are tabulated below:

| DRILL BAY | INTERSECTION |

|---|---|

| 17 | 1m @ 710g/t Au |

| 18S | 2m @ 160g/t Au |

| 18 | 4m @ 2.2g/t Au |

| 19 | 4m @ 22.8g/t Au |

| 19 | 4m @ 4.3g/t Au |

All assays quoted are Screened Fire Assays and the length weighted average grade is 77g/t Au (2.5oz/t Au). Characteristically the coarse nature and erratic distribution of gold at Bendigo results in drill core assaying being only a guide to actual grade. A best estimate grade of 20g/t Au, in the range 15 to 25g/t Au, has been assigned to the reef.

This reef will be accessed for bulk sampling during the fourth quarter of 2002. On-reef development and bulk sampling will then commence for Reserve definition.

D4 Ribbon

No testing of this ribbon was done during the quarter. Two drill sections were previously drilled into the ribbon, and on strike drill testing is planned for the fourth Quarter of 2002.

DECLINE DEVELOPMENT

The Swan decline length at the end of the quarter was 3,860 metres, some 595 metres below surface, which is slightly ahead of target of 3,800 metres. Development costs are on budget.

Statement of Financial Performance For the quarter ended 31 March 2002 (Unaudited) $A’000

Operating Expenditure 4,461

Less: Interest Received (559)

Operating Loss 3,902

Income Tax Attributable 0

Operating Loss After Income Tax 3,902

Accumulated Losses 31/12/01 67,421

Accumulated Losses 31/03/02 71,323

Statement of Financial Position As at 31 March 2002 (Unaudited) $A’000

CURRENT ASSETS

Cash & Investments 50,402

Other Current Assets 1,534

TOTAL CURRENT ASSETS 51,936

NON CURRENT ASSETS

Property, Plant and Equipment 2,648

TOTAL NON CURRENT ASSETS 2,648

TOTAL ASSETS 54,584

CURRENT LIABILITIES

Accounts Payable 3,511

Provisions 234

TOTAL CURRENT LIABILITIES 3,745

NON CURRENT LIABILITIES

Provisions 40

TOTAL NON CURRENT LIABILITIES 40

TOTAL LIABILITIES 3,785

NET ASSETS 50,799

SHAREHOLDERS’ EQUITY

Share Capital 122,122

Accumulated Losses (71,323)

TOTAL SHAREHOLDERS’ EQUITY 50,799