QUARTERLY REPORT January – March 2004

Quarterly Report January – March 2004

Summary

- Commitment by the board to proceed with mine development based on the New Bendigo Gold Project Feasibility Study

- CIBC World Markets and Austock Limited appointed as financial advisers and lead arrangers for a A$120 million share placement

Milestones

- Shareholders general meeting on 6 May 2004 to approve financing

- A$120 million capital to be raised by June 2004

FEASIBILITY STUDY

The Board of Bendigo Mining committed to proceed with mine development based on the New Bendigo Gold Project Feasibility Study completed during the quarter. The study, which was managed by AMC Consultants Pty Ltd (‘AMC’), is based on mining a total of 33.6 million tonnes over

25 years from an underground mine at a design rate of 1.6 million tonnes per year. A period of seven years is allowed to reach the design rate.

The average target mine head grade is 12 g/t Au and total recovered gold is just over 12.7 Moz. The grade in the initial years is below average and the grade increases as the higher grade target areas of the goldfield are accessed.

As the underground mine for the initial phase of production is largely pre-developed, gold production is expected to commence after a one-year plant construction period at 300,000 tonnes per year, increasing to 600,000 tonnes per year and finally to 1,600,000 tonnes per year from two production facilities, situated at the north and south ends of the Bendigo goldfield.

The initial gold output of 77,000 ounces per annum is planned to increase to 90,000 ounces per annum in the third year and then 185,000 ounces per annum in the fourth year when throughput increases to 600,000 tonnes per year. At the expected design rate of 1,600,000 tonnes per annum, gold output should be 570,000 ounces per year, which would make the New Bendigo Gold Project one of Australia’s major gold producers.

Unit mining costs are initially planned to be in the A$50-60 per tonne range, falling to A$40 per tonne at full production. Processing costs are planned to fall from A$18 to A$10 per tonne. At full production from Year 7, cash operating costs should average less than A$180 per ounce recovered or about A$70/t treated. Capital costs overall are planned to equate to A$82/oz recovered.

Financial modelling, assuming constant 2004 money terms and a gold price of A$525 per ounce, indicates that the project would have an attractive IRR of more than 20% on an ungeared and unhedged basis.

Sensitivity analysis was carried out by varying the financial model input parameters singly or in groups. It was concluded that

- The biggest potential variations (upside and downside) will arise from variation in head grade.

- The project is relatively insensitive to capital cost.

- The project is only moderately sensitive to operating costs, essentially because of the strong cash margin.

Important Notice:

The prospective financial information set out in the feasibility study and this report is predictive in nature, may be affected by inaccurate assumptions or by known or unknown risks and uncertainties, and may differ materially from results ultimately achieved.

APPROVALS

Bendigo Mining is seeking approval to expand the Carshalton operations area and the environmental impact report has been completed and exhibited. It will go before an independent panel for the State Government and approval is anticipated by September this year.

EXPLORATION

Work continues on the estimation of grade in the coarse gold environment of Bendigo. A comparison of grades from 13 trial ore parcels totalling 23,500 tonnes with grades estimated from bulk sampling and estimates done from drilling results showed only a 3% variation in results. These results further increase our confidence in the grade estimation methodology being used.

CORPORATE

Funding

Mine development based on the feasibility study and allowing a seven year period to reach design rate requires a total investment in the project of A$215 million. The investment is required over five years and will be funded in two tranches of A$135 million now and A$80 million in three years time. The first tranche is planned to be raised by an institutional placement of A$120 million and a share purchase plan of A$15 million.

Bendigo Mining has engaged CIBC World Markets and Austock Limited to undertake the institutional placement. The intended investors will be professional or institutional clients of, or investors sourced by the CIBC and Austock based locally and offshore, and are expected to include professional or institutional shareholders in the Company. It is intended that the placement be made on the basis of a global book-build to be completed this financial year.

Following successful completion of the institutional placement, Bendigo Mining proposes to implement a share placement scheme (SPP) for existing Shareholders. The SPP will allow shareholders to increase their shareholding in the Company, by a maximum of $5,000, without brokerage or stamp duty payable. The Company intends to offer shares under the SPP at the issue price for shares applicable to the institutional placement (subject to any regulatory requirements). Further details in relation to this SPP will be sent to shareholders in due course following successful completion of the institutional placement.

General Meeting

Having recently announced the outcomes of the feasibility study and details of its development strategy for the New Bendigo Gold Project, the company has called a General Meeting to be held at 11 am on 6 May 2004 at the All Seasons International Hotel, 171 – 183 McIvor Highway, Bendigo.

A Notice of General Meeting and Explanatory Memorandum has been sent to shareholders and copies are available on the company’s and ASX websites. Shareholders are encouraged to read this carefully.

In summary, the General Meeting has been convened for the purpose of seeking shareholder approval of the following proposals:

- Resolution One: the approval of an issue of up to A$120 million in fully paid ordinary shares in the Company to professional and institutional investors, at an issue price of not less than 80% of the average of the volume weighted average sale price for shares, calculated over the last 5 days on which sales in the shares were recorded before the day on which the book-build process in respect of the institutional placement commences;

- Resolution Two: a 1:10 consolidation of share capital, such that every 10 shares will be converted into one share. This is being proposed because the Directors are of the view that by consolidating the number of shares on issue, the Company is likely to be able to more effectively market the proposed institutional placement, particularly in foreign jurisdictions which are not accustomed to low share market prices. Consolidation does not of itself alter the paid up capital of the Company or the total value of your shares, it merely reduces the number of shares on issue.

- Resolution Three: the Directors also propose to convert the Company from a ‘no liability’ company to a ‘limited liability’ company. If approved, the Company’s new name will be ‘Bendigo Mining Limited’. Historically, one of the main benefits of being a no liability company was that no liability companies were not subject to restrictions on issuing shares at a discount. However, changes to the Corporations Act have abolished restrictions that were previously imposed on the issue of shares at a discount by limited liability companies. It is the Directors’ view that the removal of restrictions on the issue of shares at a discount removes a major benefit to being a no liability company. Without this benefit, it is more appropriate for the Company to conform with the majority of other companies listed on the ASX, which are ‘limited liability’ companies; and

- Resolution Four: The Directors also propose to adopt a new constitution of the Company to ensure its constitution is consistent with its change in company type to a limited liability company, and otherwise to update it.

For each Resolution to be passed, all the other Resolutions need to be passed.

Project Summary

Management is currently drafting a comprehensive summary of the project status for shareholders that will review the progress to date, the current status and the future prospects based on the outcomes of the feasibility study. It is envisaged that the document will be lodged with ASX within the next two weeks whereafter it will be mailed to shareholders.

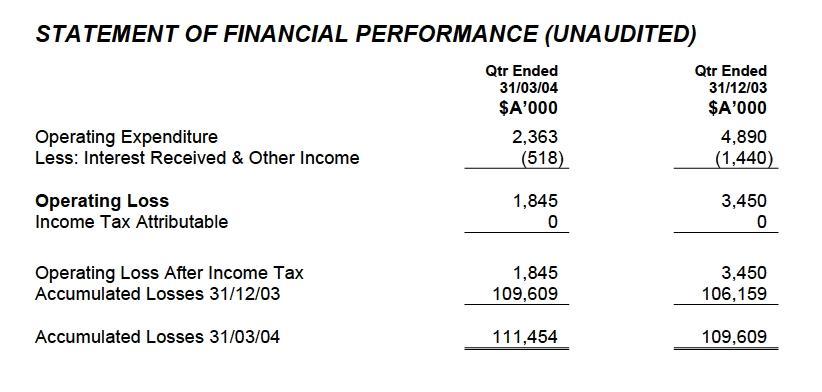

STATEMENT OF FINANCIAL PERFORMANCE (UNAUDITED)

STATEMENT OF FINANCIAL POSITION (UNAUDITED)

| As At 31/03/04 $A’000 | As At 31/12/03 $A’000 | |

| CURRENT ASSETS | ||

| Cash & Investments | 8,681 | 10,712 |

| Other Current Assets | 1,287 | 1,542 |

| TOTAL CURRENT ASSETS | 9,968 | 12,254 |

| NON CURRENT ASSETS | ||

| Property, Plant and Equipment | 4,528 | 4,570 |

| TOTAL NON CURRENT ASSETS | 4,528 | 4,570 |

| TOTAL ASSETS | 14,496 | 16,824 |

| CURRENT LIABILITIES | ||

| Accounts Payable | 930 | 1,403 |

| Provisions | 388 | 405 |

| TOTAL CURRENT LIABILITIES | 1,318 | 1,808 |

| NON CURRENT LIABILITIES | ||

| Provisions | 1,693 | 1,686 |

| TOTAL NON CURRENT LIABILITIES | 1,693 | 1,686 |

| TOTAL LIABILITIES | 3,011 | 3,494 |

| NET ASSETS | 11,485 | 13,330 |

| SHAREHOLDERS’ EQUITY | ||

| Share Capital | 122,939 | 122,939 |

| Accumulated Losses | (111,454) | (109,609) |

| TOTAL SHAREHOLDERS’ EQUITY | 11,485 | 13,330 |