QUARTERLY REPORT January – March 2005

Quarterly Report January – March 2005

Key Points

- Phase 1 production rates increased

- Capital and time estimates are robust

- Plant design and procurement on schedule

- Exploration outlines new reefs

- Institutional investors acquire 11.6% stake

Summary

Development

- • Strategy revised to increase near-term production

- Phase 1 to be constructed in one step, rather than two.

- Gold production rate of 120,000 oz/y forecast by June 2006.

- The 600,000 t/y plant cost estimate is A$53 million.

- Time and cost forecasts are robust. • Bulk earthworks planned to commence in May.

- Underground mining productivity is increasing.

Exploration

- Drilling continues to confirm the continuity and scale of gold- bearing reefs.

- The downward extent of the system is confirmed with a new ribbon identified at a depth of 1,050 m.

- New gold-bearing reefs outlined within the S3 ribbon.

- Third drill rig brought to site to accelerate exploration.

Corporate

- Company presented at the BMO Nesbitt Burns Global Re- source Conference in Tampa, Florida in late February.

- Harmony Gold Mining Company Ltd sold its 11.6% share- holding to local and overseas fund managers.

- Ted Grobicki, the Harmony representative on the Board, re- signed as a director.

- Cash and liquid assets at 31 March 2005 was $100 million.

- No debt.

PRODUCTION STRATEGY

During the quarter, the Company announced a sig- nificant shift in Phase 1 of the Bendigo Project. The plan is to increase production by constructing a 600,000 t/y gold plant in one-step, rather than two, at the southern end of the field. This will see signifi- cant rates of gold production brought forward by two years from 2008/09 to 2006/07. Production at a rate of 120,000 oz/y gold is now forecast to com- mence by June 2006.

Under the new strategy the plant will operate at 450,000 t/y with the capacity to respond to explora- tion success and increased reserves, up to the de- sign rate.

A capital cost of $53 million is estimated to construct the 600,000 t/y plant.

| 2005/06 | 2006/07 | 2007/08 | 2008/09 | 2009/10 | |

|---|---|---|---|---|---|

| Ore milled kt/y | Commission | 450 | 450 | 490 | 580 |

| Grade g/t Au | 9 | 9.5 | 10 | 10 | |

| Production oz/y | 120,000 | 130,000 | 150,000 | 170,000 |

Cash costs are estimated to be in the order of A$380/oz in the first three years.

Phase 2 of the project forecasts an increase in production to around 500,000 oz/y gold by 2011/12. This will require another decline and an additional 1 Mt/y gold process plant in the north of the field.

PROJECT DEVELOPMENT

The timetable and capital cost to construct the plant are realistic. The design is based on extensive met- allurgical testwork and trials at the Company’s New Moon pilot plant. Ausenco Ltd, a reputable engineer and project manager, is designing and managing the plant construction.

The plant is designed to minimise processing risk, maximise gold recovery, and ensure the facility meets environmental guidelines to protect the Com- pany’s license to operate for many decades.

Engineering & Procurement

Detailed design of the plant is on schedule. Process flow sheets are complete, design criteria are com- plete and layout design is close to completion.

Supply contracts have been let for the high-pressure grinding rolls, jaw and secondary crusher, ball mill, primary feeder, jigs and the centrifugal concentrator.

Project commitments are 10% complete.

Construction

Geotechnical drilling for the plant site is complete. Bulk earthwork contracts are out to tender, with work forecast to commence in late May. Tailings storage facility designs are planned to be completed next quarter.

MINING

Activity underground is focussed on advancing the main decline and an exploration strike drive to the south. This gives access to new ventilation rise sites and additional drill platforms.

Macmahon Underground contractors were mobilised to site in December and currently have 44 people on site. The equipment fleet is being expanded over the coming months.

Underground development of 456 m was completed and will increase as productivity rises and additional equipment is supplied.

Detailed stope design and mining, in preparation for production, is expected to occur late in the Decem- ber quarter.

EXPLORATION

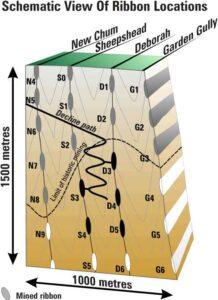

The 11 Moz Inferred Mineral Resources at Bendigo are supported by the highly repetitive geology of the field. Drilling continues to confirm the geological model by outlining gold-bearing reefs of predicted size and location.

The size of individual reefs can be very large, as dis- played by a 670 m long reef in the S3 ribbon. The vertical continuity is also displayed by confirmation of the D5 ribbon at a depth of 1,050 m.

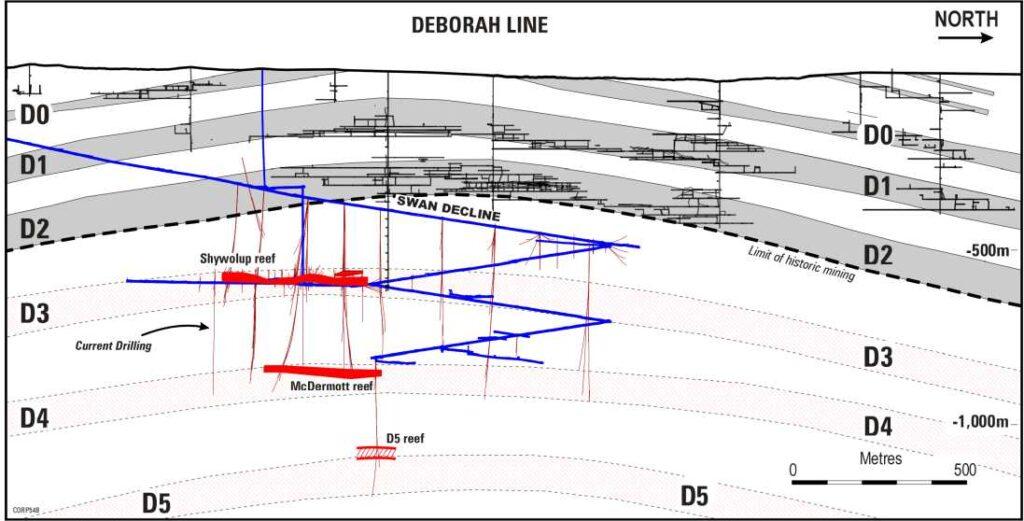

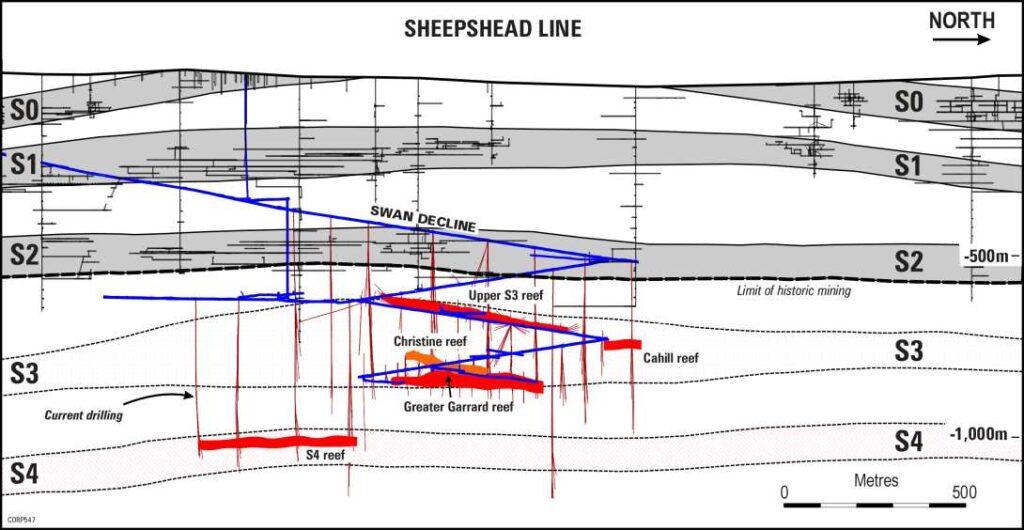

Drilling is aimed at extending reserves close to the decline on the Sheepshead and Deborah Lines.

The medium term goal is to define additional re- sources along strike, which requires underground horizontal drives to the north and south to provide drill access. This is underway in the south where a drive is being excavated. Any discoveries of reef made in the area will be outside the Inferred Mineral Resources.

Current Activity

Drilling of 4,100 m of diamond core was completed in the quarter. A third underground diamond drill rig was brought to site by our drill contractor Boart Longyear.

Exploration has tested a combined 1.5 km along the Sheepshead and Deborah Lines. Due to vertical stacking, 2.65 km of gold-bearing reef is defined. This quantity of mineralisation is similar to that re- corded from historical mining.

Sheepshead line

S3 ribbon

Four gold-bearing reefs are currently identified:

- Upper S3 reef: drilling extended the reef north and south to a length of 670 m. Further drilling awaits development of drill access.

- Christine reef: minor extensions made to the length of 225 m; reef now closed off.

- Greater Garrard reef: No drilling possible until drill access is gained in late April. Current length is 420 m and remains open.

- Cahill reef: A new discovery with encouraging grades on two sections 80 m apart. In-fill drilling is in progress.

S4 ribbon

- S4 reef: defined over 460 m; remains open with strong mineralisation to the north. A 250 m step- out to the north is being drilled next quarter to test for continuity.

Deborah line

D3 ribbon

- Shywolup reef: Drilling has defined the full extent of the reef to a length of 530 m.

- New Formation Reef: A possible new reef located below Shywolup.

D4 ribbon

- McDermott reef: High-grade reef drilled over 270 m and remains open.

D5 ribbon

- Drilling at a depth of 1,050 m has identified a lithological and structural target that indicates a reef in the D5 position.

FINANCE

The interim financial result was released on 28 Feb- ruary 2005 and recorded a loss of $5.4 million in line with the Company’s policy to expense exploration expenditure as it is incurred. The balance sheet has no capitalised exploration expenditure and $7.2 mil- lion in capitalised mine development and property, plant and equipment expenditure; despite historical expenditure of $105 million.

At 31 March 2005 the Company held cash and liquid assets of $100 million.

Expenditure

The $6 million cash spent this quarter was predomi- nantly on underground development of the south exploration drive and exploration drilling. The ex- penditure profile will increase rapidly over the course of the year as construction accelerates.

A study to assess cost inflation on Phase 2 is under- way. Information should be available by June to generate a long term development and financing plan. In the interim, the Company is assessing fi- nancial options to support future plans.

CORPORATE

The Company presented at the BMO Nesbitt Burns conference in Tampa Florida, US in early March 2005. Post the conference, a three-week marketing round was conducted to institutional investors in North America, Europe and Asia.

In early April, Harmony Gold Mining Limited sold its 11.6% stake in the Company to a broad range of international and local institutional investors. Ted Grobicki, the Harmony representative on the Bendigo Mining Board, resigned after the sale was concluded.

The information in this Public Report that relates to Exploration Results, Mineral Resources or Ore Reserves is based on, and accurately reflects, information compiled by G.F. Johansen who is a Member of The Australasian Institute of Mining and Metallurgy. Mr Johansen is a full time employee of the Company and has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined in the 2004 Edition of the Austral- asian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves. Mr Johansen consents to the inclusion in the report of the matters based on the information in the form and context in which it appears.