QUARTERLY REPORT January – March 2007

QUARTERLY REPORT January – March 2007

Key Points

- Encouraging drill results from the Garden Gully line.

- Testing of an exploration ‘hot spot’ to commence.

- Production of 12,822 oz at an improved grade of 6.8 g/t.

- Business restructure completed.

Summary

Rod Hanson, Managing Director and CEO Comment: “This quarter was a turning point for the Company. I am pleased to report that we successfully redirected our exploration into the more prospective Garden Gully line; determined a better way of interpreting exploration data; and delivered a solid operating result from the remaining available ore.

We have committed to a fundamentally different approach in our exploration, and in line with this approach we are now making assessments of size and quality of mineralisation based on a combination of visual estimates, assays and our accumulated knowledge.

The reefs discovered so far at the southern end of Garden Gully are modest in size, but are displaying an intensity of gold mineralisation which I believe is better than anything we have seen to date. We have a clear exploration goal, some excellent targets to test and the infrastructure in place to capitalise on success”.

Exploration

- Drilling on three sections spaced over 1.1 km was completed into the southern Garden Gully zone and discovered two new reefs. Both reefs are open along strike, with one reef (Grenfell) defined on two sections, 460 m apart. The results from Grenfell reef are encouraging and it is possibly larger than anything the Company has mined to date.

- The strength of mineralisation so far intersected in southern Garden Gully is similar to the endowment in the historical workings above the drilling.

- Underground access is now adjacent to the southern end of a 1.5 km long zone of central Garden Gully where historic mining produced some 1.6 Moz at 16 g/t gold. The historical gold endowment of this area is significantly greater than southern Garden Gully where drilling is currently underway. Testing of the central Garden Gully zone is planned to commence in May.

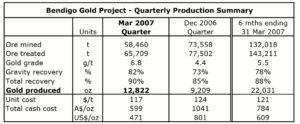

Production

- March quarter production increased 39% to 12,822 oz at a head grade of 6.8g/t gold. Cash operating costs were A$599/oz (US$471/oz).

- Production in the month of March achieved a grade of 8.6 g/t which approximates the original reserve grade.

- As previously announced, processing of remaining accessed ore is planned for completion in May.

Corporate

- Gold sales of 11,940 oz at an average price of A$825/oz were achieved.

- Cash in bank as at 31 March 2007 was $68.8 million. The focus is on reducing expenditure and maximising cash to support the Company’s exploration strategy.

BUSINESS STRATEGY

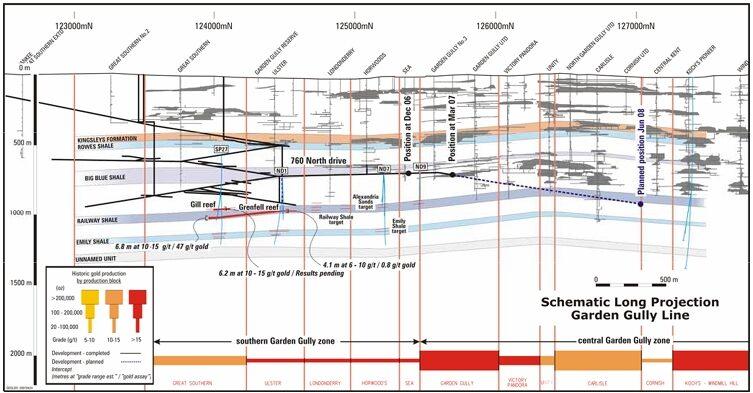

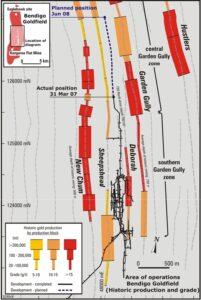

Bendigo Mining’s revised exploration program is targeting the more highly endowed Garden Gully and New Chum lines of mineralisation at depths of around 800 m to 1,200 m. These lines account for some 70% of Bendigo’s historic gold production and are the key exploration targets (see plan on page 7). Drilling is conducted from underground openings at a depth of around 760 m below surface.

The Company has a permitted operation and ownership of a large underground mine developed to 900 m depth and over 2.5 km in length. A new process plant rated at 600,000 t/y, along with mining equipment and necessary infrastructure (ventilation, dewatering pumps, water treatment plant and pipelines), is in place to capitalise on future exploration success.

EXPLORATION

The exploration aim is simple: to find larger or higher grade reefs than those mined to date and to interpret them accurately from drill core. Company geologists are confident they can identify economic grade-ranges and the size of reefs from a combination of visual inspection of the drill core and assay data. In recognition of the renewed exploration focus the restructured exploration team reports directly to the Managing Director and CEO.

Gold mineralisation at Bendigo consists predominantly of large particles of gold (i.e. visible grains) in quartz veins. Despite the issues with estimating grade at Bendigo by assaying the small samples obtained in drill core, the key estimation error in the initial Reserves related more to the interpreted size of mineralised zones than grade. In the past, an overemphasis on grade estimation resulted in a process where statistically-factored gold grades (mathematically adjusted assays) incorrectly defined the boundaries of mineralisation.

The Company now uses a more fundamental approach which is better suited and appropriate to local conditions. Company geologists use their accumulated knowledge to make assessments of size and quality of mineralisation based on the visual examination of core. This geological assessment is backed by assays, the knowledge gained from processing over 140,000 t of ore and a reassessment of core drilled through those mined areas. This is a very different approach and will continue to be refined as more information is gathered.

Significantly, the Company will no longer report factored gold assays and will not refer to ribbons (the name used for the occurrence of gold-bearing reefs repeating vertically every 250 m). The Company is able to define stratigraphic units (identifiable packages of rock or strata) that are favourable hosts for gold mineralisation and use them as targets for exploration.

Exploration Activity

Current exploration is focussed on the Garden Gully and New Chum lines using the data from historical mining as a guide to the more productive regions. Drilling is conducted beneath or along from historic mines searching for extensions of mineralisation.

Individual reefs can now be targeted in a costeffective manner using a simple geological concept: the intersection of significant laminated quartz veins and anticlinal axes. The potential grade-range and size of reefs will be interpreted from drill core, with mining decisions likely to be based on Inferred Resources, rather than attempting to resolve the accuracy of estimates through costly, detailed, infilldrilling.

The immediate target is the 1.5 km central Garden Gully zone which produced some 1.6 Moz at 16 g/t gold from surface down to a depth of approximately 750 m (see long section on page 8). The area beneath these workings is an exploration ‘hot spot’ as the historical workings were significantly richer in gold endowment than the southern Garden Gully zone where drilling is currently underway. Three favourable stratigraphic units are being targeted over the same strike length and over a vertical interval of around 250 m.

The 760 North drive to provide drill access is being developed at a depth of 760 m parallel to the Garden Gully line and offset by around 250 m to the west of the line. This development has just entered the southern end of the central Garden Gully zone ‘hot spot’, with drilling planned to commence in May.

Exploration Results

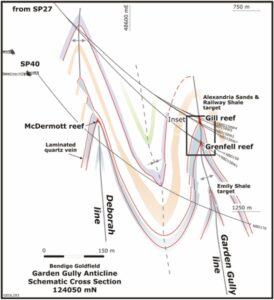

The revised exploration strategy commenced with the drill-testing of the Garden Gully anticline on three widely spaced sections. The key focus of this quarter’s exploration effort was to locate prospective stratigraphic units with potential to host gold mineralisation.

A total of 10,998 m of diamond core was drilled, with most focussed on Garden Gully. The drilling completed to date has identified three prospective units in the Garden Gully anticline over a strike extent of 1.1 km. These units are the base of the Alexandria Sand, the Railway Shale and the Emily Shale, all of which host mineralised reef systems in the Deborah and Sheepshead lines. Drill-testing of these three prospective units identified two mineralised reef systems – Grenfell reef and Gill reef.

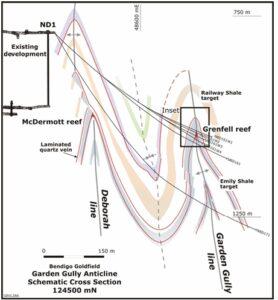

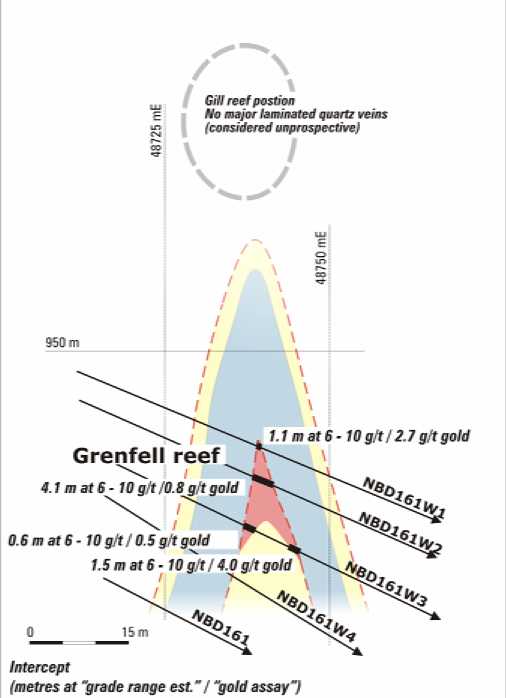

Grenfell reef

The Grenfell reef is formed at the top of a folded sequence of rocks at the intersection of a significant laminated quartz vein and the anticlinal axis in the Railway Shale unit (see schematic cross-sections on page 6). This reef was intersected in drilling on two sections approximately 460 m apart (SP27 – 124050 mN and ND1 – 124510 mN), but was not found 695 m to the north of ND1 on section 125205 mN.

The reef is currently interpreted to be a saddle reef with highly encouraging quartz textures, sulphides and visible gold intersected in drill core.

The reef is approximately 10 – 12 m high from the base to the top of the saddle and between 6 – 9 m wide at the base of the saddle (see detailed crosssection below).

Based on current mining experience, saddle reefs tend to be highly continuous and predictable zones of mineralisation. The size of this reef, whilst modest, has potential to be greater than any zone of mineralisation defined by the Company on the Sheepshead or Deborah lines.

The geological grade range estimate, based on the physical characteristics of the core are outlined in the following table. The influence of assay data on the grade-range estimate is subject to ongoing review.

| Hole number | Lengthn (m) | >Est. true width (m) | Geological grade range estimate (g/t gold)1. | Gold assay (g/t)2. | Quartz (%) |

|---|---|---|---|---|---|

| NBD158W1 | 6.8 | 5.5 | 10 – 15 | 47 | 83 |

| NBD161W1 | 1.1 | 1.0 | 6 – 10 | 2.7 | 37 |

| NBD161W2 | 4.1 | 3.9 | 6 – 10 | 0.8 | 98 |

| NBD161W3 | 0.6 | 0.5 | 6 – 10 | 0.5 | 90 |

| 1.5 | 1.3 | 6 – 10 | 4.0 | 90 |

- *1. The geological grade range estimate is based on a ranking of the key geological textures and minerals visible in the drill core: including quartz percent, quartz textures, presence of free gold and sulphides. The use of this ranking, in combination with assays, provides a meaningful method of estimating the likely gold grade range of the intercept.

- *2. Screen fire assay. Assays will usually under-estimate but may also over-estimate the true gold grade due to the large gold particle size of mineralisation at Bendigo.

Gill reef

The Gill reef was intersected on the southern most drill-section (SP27 – 124050 mN) approximately 60 m above the Grenfell reef (see cross-section 124050 mN on page 6). The reef is formed at the top of a folded sequence of rocks at the intersection of a significant laminated quartz vein at the base of the Alexandria Sands unit and the anticlinal axis.

It is interpreted to be a 25 – 30 m high, 3 – 9 m wide neck reef (see detailed cross-section below). From mining experience, neck reefs are moderately predictable, being somewhat less consistent than saddle reefs, but significantly more predictable than stockwork reefs.

The drill core geology indicates a low-grade reef system in the range of 2 – 6 g/t gold. However, significant coarse visible gold (pieces up to 0.5 cm in diameter) in one intersection does highlight potential for higher grade. Assay results are pending. Drilltesting for this reef along strike is underway.

The Gill reef is open to the south and has potential to extend up to 400 m to the north as it was not intersected on ND1 at 124510 mN. Significant drill intersections obtained in the quarter are displayed in the table below. Assays are pending and may influence the final grade-range estimate.

| Hole number | Length

(m) |

Est. true width (m) | Geological grade range estimate (g/t gold) 1′ | Gold assay (g/t) 2‘ | Quartz

% |

| NBD158W2 | 9.4 | 8.5 | 2 – 6 | pending | 80 |

| NBD158W3 | 0.9 | 0.7 | 2 – 6 | pending | 95 |

| NBD158W4 | 3.3 | 3.0 | 2 – 6 | pending | 95 |

| NBD158W5 | 6.2 | 5.6 | 10 – 15 | pending | 95 |

1 & 2 Refer to footnote on previous table.

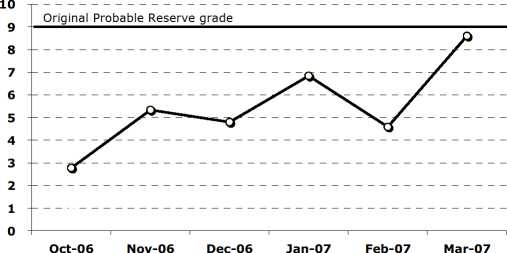

PRODUCTION

Results to date are encouraging despite the disappointment with initial Reserves. The improved head grade shows that Bendigo reefs can be mined and processed economically using modern methods. Head grades have averaged 5.5 g/t gold over the past six months which is positive considering the levels of dilution incurred due to the mining of narrower than predicted mineralised shapes. The grade of 8.6 g/t achieved in March is very close to the original Probable Reserve estimate of 9 g/t gold. Total cash cost was A$413/oz (US$327) in the month of March.

As announced previously, production from the weakly endowed Sheepshead and Deborah lines will be suspended once accessed ore has been mined. Processing of ore and low grade stockpiles will continue until May at which time the plant will be placed on care and maintenance. Employee numbers are planned to reduce from current levels of 180 to 100 at that time.

Safety

The safety performance was disappointing with four lost time injuries (LTI’s) in the quarter, compared to no LTI’s in the December 2006 quarter. None of the LTI’s resulted in a significant period of lost time from the workplace. The year-to-date medically referred injury frequency rate (MRIFR – is the sum of lost time plus medically treated injuries per million man hours) at the end of the March quarter was 26 compared to 18 at the end of the December 2006 quarter.

In response to this performance, efforts have been refocussed on the assessment and control of hazards.

Gold Production

Production during the quarter was 12,822 ounces at a head grade of 6.8 g/t gold. This grade is similar to the average grade anticipated following the reserve downgrade in October 2006. Performance for the month of March was pleasing with a head grade of 8.6 g/t gold.

The March grade of 8.6 g/t gold was derived from ore sourced entirely from the McDermott (6.9 g/t), Garrard (9.4 g/t), and Shywolup (10.3 g/t) reefs. These grades reinforce the high grade nature of the cores of the reefs, however, the tonnages available for mining are limited.

The total operating unit cost for the March quarter was A$117/t, (month of March being $104/t) in line with predicted levels despite less tonnes processed.

Processing

The process plant achieved high levels of gold recovery, with good performance from the gravity gold circuit. Gravity recovery of 82% was achieved on the higher grade ore treated in the March quarter. Some intermittent issues relating to reduced CIL gold recovery re-emerged during the quarter. Testwork on selected CIL tail samples is underway to further assess this matter. High wear rates on the high pressure grinding rolls continue to be monitored and are being addressed by the manufacturer.

Mine Development

Underground mine development was in line with forecast at 1,166 m (1,600 m achieved in the December 2006 quarter). The 760 North Drive is now the main development activity with the balance of the development associated with production.

The 760 North Drive advanced 263 m in the quarter and is currently 1,278 m north of the main decline infrastructure. Late in the quarter, this horizontal drive was converted to a 1 in 6.5 down decline. This change was made to place the drive closer to the highly prospective central Garden Gully zone.

Infrastructure

Dewatering of the historic mine workings is an important safety element of the development strategy. Dewatering is planned to increase from 2 million to 7 million litres per day during the June quarter in order to dewater historic workings in the Garden Gully and New Chum lines. A $4.6 million water treatment plant at the New Moon site is currently undergoing final commissioning. A pipeline to transport treated water from New Moon to the local water authority, for community reuse, is largely complete and will be commissioned in April 2007.

CORPORATE

Cash in bank as at 31 March 2007 was $68.8 million ($79.9 million at 31 December 2006 calculated on a comparable basis). This is better than forecast due to an increased focus on cost reductions in all areas of the business.

Non-operating expenditure for the quarter was $9.6 million and included: $2.5 million on exploration, $4.2 million on mine development and infrastructure, $2.7 million on mine dewatering and the water treatment plant. Expenditure for the June quarter is planned to decrease, particularly in mine infrastructure and water treatment.

The Company is reviewing all assets with a view to maximising the cash available to support the exploration strategy. An auction of surplus mining equipment is scheduled for late May.

During the quarter the Company sold 11,940 oz at an average price of A$825/oz.

Logging, Sampling and Assaying Techniques

Each intercept is logged by lithology and mineralisation, with samples generally selected according to mineralisation style. The minimum sample length is 0.5 m, with a maximum of 1.4 m. The typical size of drill core is NQ2, with half-core samples dispatched for analysis. Full-core samples are typically used with smaller diameter core.

All sample preparation and analysis for gold and arsenic is completed at a National Association of Testing Authorities accredited laboratory. All reef intersections are routinely analysed by screen fire assay. Preparation for a screen fire assay involves crushing and pulverising of the sample such that >90% can pass through a -75 um mesh. The sample is then dry-sieved through a -107 um mesh, with the entire plus fraction (the coarser grained material) assayed by fire assay and a representative sample of the minus fraction (the finer grained material) assayed by fire assay; both sets of assays are completed using atomic absorption spectroscopy. The screen fire head grade is then calculated by the weighted average of the individual assay results. Arsenic is analysed utilising x-ray fluorescence. The reported intersection assay grades are a length weighted average of all the samples in the intersection.

Competent Persons Statement

The information in this public report that relates to Exploration Results and Mineral Resources is based on, and accurately reflects, information compiled jointly by Richard Buerger and Jim Dugdale. Richard Buerger is a Member of The Australasian Institute of Mining and Metallurgy and Jim Dugdale is a Member of the Australian Institute of Geoscientists. Both are full time employees of the Company and have sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which they are undertaking to qualify as Competent Persons as defined in the 2004 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves. Richard Buerger and Jim Dugdale consent to the inclusion in the report of the matters based on their information in the form and context in which it appears.