QUARTERLY REPORT July – September 2001

QUARTERLY REPORT JULY – SEPTEMBER 2001

Highlights

- Agreement with Harmony Gold Mining Company to fund the development of the New Bendigo Gold Project:

- A$50 million through an issue of 294.1 million shares at 17 cents per share giving Harmony an interest of approximately 33.6%

- Options to subscribe for 360 million further shares at 30 cents each by December 2003 to raise an additional A$108 million and give Harmony an interest of approximately 52.9%

- Drilling extends mineralisation 140m north of the existing S3 Ribbon Inferred Resource

- Further metallurgical testing confirms 98% gold recovery with coarse grind and no cyanide

In this document, the term “resource potential” is used to describe the Company’s estimate of the contained ounces of gold which it believes, on the basis of a technical evaluation of available data and geological extrapolation, should occur within the New Bendigo. It is emphasised that this term is not covered by the JORC Code and is not equivalent to a Mineral Resource or Ore Reserve estimate.

The information in this report that relates to Mineral Resources or Ore Reserves is based on, and accurately reflects, information compiled by G F Johansen, Member of the Australian Institute of Mining and Metallurgy. Mr Johansen is a full-time employee of the Company and has relevant experience in relation to the mineralisation being reported to qualify as a Competent Person as defined in the Australian Code for Reporting of Mineral Resources and Ore Reserves. Mr Johansen consents to the inclusion in the report of the matters based on the information in the form and context in which it appears.

EXPLORATION

Drilling Results

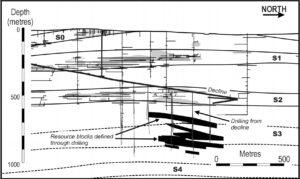

Drilling of New Bendigo mineralisation from the Swan Decline continued during the quarter. Diamond drilling for the quarter amounted to 4,866 metres. Of this 4,167 metres were drilled into the S3 Ribbon on the Sheepshead anticline and 699 metres were drilled into the D4 Ribbon on the Deborah anticline. Most of the drilling was carried out on Sheepshead drill section SP20 and SP24 as indicated on the diagram below. The SP24 drill section is 140 metres further north than any previous drilling and, although assays are awaited, the visual results to date indicate that mineralisation continues through and beyond this section extending the gold bearing quartz stockwork zones on the S3 Ribbon to over 650 metres of strike. The S3 Ribbon mineralisation remains open to the north and south. Total diamond drilling from the Swan Decline now stands at 36,536 metres.

Significant intersections for which assays were received this quarter are listed below.

Sheepshead

| Hole ID | Drill Section (Stockpile Bay) |

Length (metres) |

Grade (g/t Au) |

|---|---|---|---|

| NBD 031 W1 | SP21 | 3,7 | 5,2 |

| NBD 043 W2 | SP23 | 2,8 | 9,4 |

| NBD 044 W11 | SP23 | 3,0 | 102 |

| NBD 046 W3 | SP20 | 3,0 | 14,6 |

| NBD 046 W3 | SP20 | 2,0 | 9,0 |

METALLURGY

Results from metallurgical test work

Following the initial metallurgical appraisal of underground samples further testing has been completed. A 150kg sample was dispatched to Amdel Ltd for grind, gravity and flotation testing. The results of metallurgical testing continue to be positive with results indicating gold recoveries of around 98%. Between 90 to 94% of the gold can be recovered by simple gravity processing and the remainder by sulphide flotation with no cyanidation. Importantly it has been found that the high gold recoveries are not particularly dependent on grind size with testing at grinding to 75um, 150um, 212um, and 300um making little difference to overall gold recoveries.

The simple gravity and flotation recovery circuit has the potential to reduce both capital costs for the recovery plant and ongoing operating costs. The mining and recovery circuit layout will be designed to gain maximum benefit from the opportunities presented by the straightforward metallurgy of the Bendigo goldfield.

A significant advantage will be the environmentally friendly recovery, which will obviate the use of cyanide in the main circuit.

CORPORATE

A$50 million Capital Raising

Following an extensive and rigorous process the Directors of Bendigo Mining NL (‘Bendigo’) agreed to accept an offer from Harmony Gold Mining Company Limited (‘Harmony’) of South Africa. Subject to Shareholder and regulatory approvals Bendigo will raise A$50 million in cash via a placement of 294.1 million shares to Harmony at 17 cents per share. This will give Harmony an interest of approximately 33.6% in Bendigo. The funds will be employed by Bendigo to continue development of the next stage of the New Bendigo Gold Project with the commencement of gold production targeted for the fourth quarter of 2003.

Bendigo will also grant Harmony options to acquire 360 million shares in Bendigo at 30 cents per share, exercisable at any time before 31 December 2003. Should Harmony exercise all of its options, it will inject a further A$108 million into Bendigo and hold approximately 52.9% of the company.

Harmony produces approximately 2.5 million ounces of gold per annum, principally from its extensive interests in the Witwatersrand complex in South Africa, and including approximately 220,000 ounces of gold per annum from its operations in Western Australia. Harmony has experienced significant growth over the last five years and has emerged as one of the top gold producers in the world. The Directors anticipate that Harmony’s underground mining experience will be particularly beneficial in the development of the New Bendigo Gold Project.

The shareholders of Bendigo will be asked to approve the deal with Harmony at the upcoming Annual General Meeting. Subject to ASIC approval the meeting is planned for 13 December and a Notice of Meeting and Explanatory Memorandum will be mailed to Shareholders in early November.

Statement of Financial Performance For the quarter ended 30 September 2001 (Unaudited) $A’000

Operating Expenditure 2,633

Less: Interest Received (88)

Operating Loss 2,545

Income Tax Attributable 0 Operating Loss After Income Tax 2,545

Accumulated Losses 30/06/01 62,604

Accumulated Losses 30/09/01 65,149

Statement of Financial Position As at 30 September 2001 (Unaudited) $A’000

CURRENT ASSETS

Cash & Investments 4,892

Other Current Assets 1,085

TOTAL CURRENT ASSETS 5,977

NON CURRENT ASSETS

Property, Plant and Equipment 2,525

TOTAL NON CURRENT ASSETS 2,525

TOTAL ASSETS 8,502

CURRENT LIABILITIES

Accounts Payable 852

Interest-Bearing Liabilities *See note below 6,392

Provisions 170

TOTAL CURRENT LIABILITIES 7,414

NON CURRENT LIABILITIES

Provisions 20

TOTAL NON CURRENT LIABILITIES 20

TOTAL LIABILITIES 7,434

NET ASSETS 1,068

SHAREHOLDERS’ EQUITY

Share Capital 66,217

Accumulated Losses (65,149)

TOTAL SHAREHOLDERS’ EQUITY 1,068

Note: Redeemable convertible notes maturing on completion of the placement to Harmony. The redemption proceeds (including interest) must be applied to pay for new shares in the Company (Please refer to the announcement made on 24 April 2001 for the principal terms of the greement).