QUARTERLY REPORT October – December 2005

QUARTERLY REPORT October – December 2005

Key Points

- Plant Construction on schedule

- Stockpiling of ore commenced

- Transition to owner-mining underway

Summary

Development

- Plant construction is 57% complete and on schedule.

- Major capital items are meeting budget.

- Increased labour costs and minor scope changes are likely to cause a small increase in the initial $53 million capital estimate of around $2-4 million.

Mining

- Mine development of the Shywolup reef has commenced.

- Bulk-sampling of development rounds is planned as a further step in evaluating grade prior to commercial production.

- The Adam Street ventilation circuit is taking longer than planned but is not expected to affect the production ramp-up.

- Transition to owner-mining status is underway, with three trucks delivered in December.

Exploration

- McDermott reef has potentially doubled in length.

- A new zone intersected in the D4 ribbon.

- No significant results south of the Greater Garrard reef.

- D5 target continues to show promise but needs more drilling.

Corporate

- $140 million capital raising completed during the quarter.

- Cash in bank at 31 December 2005 was $179 million ($158 million net of creditors).

- Jardine Fleming Capital Partners is a new substantial shareholder.

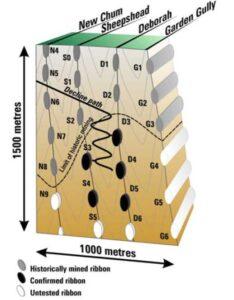

Bendigo Mining Limited is developing one of the world’s largest and highest-grade new gold projects. The Bendigo Goldfield produced some 22 million ounces of gold over a century of mining, and today is estimated to contain high-grade gold mineralisation of over 11 million ounces beneath the historic workings. Once fully developed, the mine is planned to produce over 600,000 ounces of gold a year for more than 20 years, which would position Bendigo Mining as one of Australia’s largest long-life gold producers.

Phase 1 production is planned to commence by June 2006 at a rate of 120,000 oz/y and build to 200,000 oz/y after three years, with full-scale production of 600,000 oz/y planned to commence in 2011/12.

PRODUCTION STRATEGY

The mine is planned to be developed in two phases. Phase 1 is south mine production from June 2006 to June 2011. The southern plant is planned to be initially operated at 0.45 Mt/y for three years, producing 120,000 oz/y, before increasing to nameplate capacity of 0.6 Mt/y from 2009/10, producing 200,000 oz/y. Phase 2, the north mine, is planned to add a further 400,000 oz/y in 2011/12 after commissioning of the 1 Mt/y northern plant.

At full capacity, after 2011/12, the project is planned to produce over 600,000 oz/y gold at cash operating costs of around A$200/oz; utilising twin declines, shaft haulage and two processing plants. This plan would place the mine as the third largest gold mine in Australia and one of the top 20 gold mines globally (Brook Hunt, Macquarie Bank research January 2006).

PROJECT DEVELOPMENT

Construction of the 600,000 t/y south mine gold plant continued during the quarter. Plant engineering, procurement and construction management services are being provided by Ausenco Ltd.

The plant flowsheet incorporates three-stage crushing, including high pressure grinding rolls, grinding, intensive gravity processing, sulphide flotation and carbon-in-leach processing of the flotation concentrate.

Plant construction is on schedule for commissioning in the June quarter of 2006. The $53 million capital cost forecast for the plant is being challenged by higher labour costs impacting the industry at large, and a number of small scope changes. The cost of equipment and components remain on budget. The final plant cost could be $2-4 million higher than budgeted but is expected to remain within the accuracy of the original estimate of ±10%.

Engineering and Procurement

Detailed engineering design is 96% complete.

Procurement is now largely complete apart from some minor variations to siteworks. Orders were placed for the fine ore bin, HV switchgear, tanks, platework, samplers, elution columns, agitators, mechanical installation and electrical installation.

Construction

Overall site construction is 57% complete. Installation of steelwork and major equipment items commenced as planned. Key activities included:

- completed below-ground crushing station,

- primary and secondary crushers placed into position,

- completed HPGR, ball mill, screening and leaching foundations,

- installed HPGR into position,

- screen and HPGR structural steelwork commenced,

- lifted ball mill into position and installed motor and drive train,

- installed CIL and flotation tanks,

- thickener tanks installed.

Construction is progressing to plan and is displayed in the accompanying photographs.

Site manning levels total 58 personnel, with the majority employed by Ausenco, Ausform and McFee.

The electrical installation contract has been awarded to CB & M Design Solutions, a local Bendigo contractor, who has now mobilised to site.

Construction of the sands, tailings and rock storage area continued.

MINING

Underground development of 1,151 m (1,012 m in the September quarter) was completed. Productivity is planned to increase with the introduction of a larger capacity truck fleet.

Development priority was given to the continued extension of the north drive, which is required for drill platform and ultimately for a link to the north mine. The initial development of the Shywolup orebody commenced. Development ore from the Shywolup sill drive is being stockpiled for commissioning of the process plant.

Three Atlas Copco 50-tonne capacity haul trucks were purchased and delivered during December after the successful testing of larger haul trucks last quarter. All of the smaller 27 and 40 tonne trucks are being demobilised from site.

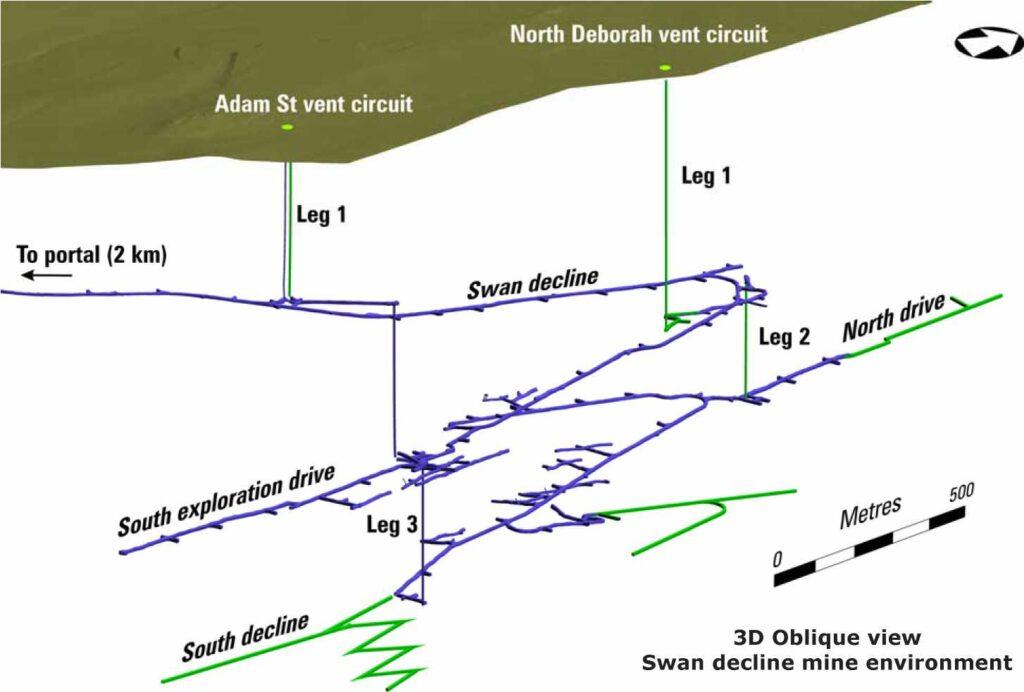

Work on the Adams Street ventilation circuit is ongoing (see page 6 for location). The underground rise, Leg 3 (4 m in diameter and 242 m long commencing at a depth of 600 m) was completed and commissioned during the quarter. The surface rise, Leg 1 (3.5 m in diameter and 334 m long) is some months behind schedule with our raise bore contractor having reamed 129 m with 205 m remaining. Problems relate primarily to equipment reliability.

Increased ventilation from Leg 1 is necessary for the planned increase in underground development. The circuit is now planned to be fully commissioned by May and under this timing the production plans are not affected.

Development of the second ventilation circuit, the North Deborah circuit, some 700 m north of the Adam Street circuit, has commenced (see page 6 for location). A second contractor is working on the underground leg (Leg 2) and has completed the 212 m long pilot hole.

The Company has completed approximately 1,000 m of raise boring at Bendigo. This experience is assisting in the selection of appropriate equipment and techniques for the deeper rises planned.

Owner-Mining

The mining strategy adopted in the 2004 Feasibility Study and the more recent August 2005 Development Study was to commence operations using a mining contractor, to ensure a rapid development ramp-up, but within a short period of time become an owner- operator. In support of this strategy, the Company plans to commence owner-mining on 2 April 2006.

Key issues in the move to owner-mining have been addressed including access to a skilled workforce, access to a mining fleet, spare parts, maintenance and systems.

The first components of the fleet, 3 x Atlas Copco MT5010 50-tonne trucks, have been purchased at a combined cost of $4.5 million and were delivered to site in December. The majority of the balance of the fleet is planned to be delivered during the March and June quarters of 2006. Letters of intent have been provided for two Atlas Copco jumbos which are in Perth awaiting delivery and two Caterpillar Elphinstone loaders which are in Tasmania awaiting delivery. This fleet will increase in size over the year to 4 x trucks, 3 x jumbos and 3 x loaders.

The capital cost of the fleet to deliver 450,000 t/y ore production is approximately $21 million.

The mining strategy is unchanged, except that equipment is being purchased outright, rather than leased. This decision lowers the cost of acquisition and shifts some of the capital expenditure to this financial year, rather than spreading it over the next four to five years.

Mobile equipment leasing, as a financial tool, is not advantageous at Bendigo because the leases amortise within the 5-year ramp-up profile of the mine. That is, leasing does not lessen the capital expenditures in the early capital-intensive phase of the mine and in fact adds to the cost due to interest payments.

The financial impact of this decision will primarily relate to a lower cash balance at the end of the 2006 financial year, offset by no lease payments over the next four to five years. On average, the two items should balance each other out with the main saving related to the margin between the lease charge and the interest earned on cash.

Grade Control

It is currently planned to undertake further bulk- sampling and processing from the development rounds sourced from the Shywolup sill drive. A number of 10 t bulk samples will be processed at the New Moon bulk-sampling circuit as a further risk- minimisation step in evaluating grades prior to commercial production.

EXPLORATION

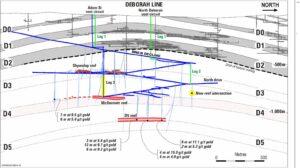

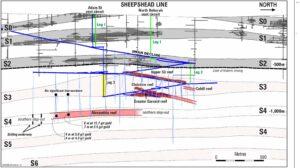

The 11 Moz Inferred Resource at Bendigo is supported by the highly repetitive geology of the field. The geological model (ribbon model) predicts the occurrence of gold-bearing reefs repeating vertically every 200-250 metres. Exploration confirms this on the Deborah and Sheepshead Lines and reinforces the reliability of the geological model (see attached long sections showing stacked ribbons).

Exploration success at Bendigo is driven by having appropriate geological targets combined with available underground drill platform. As mine development rates increase, the available drill platform increases and the ability to test for extensions of existing reefs and new targets also increases.

Current Activity

Drilling of 9,297 m of diamond core was completed in the quarter (a 31% increase on the previous quarter of 7,077 m). Four underground diamond drill rigs are engaged in the program. Productivity levels have increased to expected levels and this is reflected in the increase in drill metres this quarter.

Exploration activity returned good results from the McDermott reef, which was previously considered to be a 400 m long low-priority reef in the D4 ribbon.

Drilling this quarter indicates the reef could extend an additional 400 m to the south and potentially to the north (see page 7: Deborah line).

A potential new zone of mineralisation was also encountered in drilling to the north in D4, around 100 m below the north drive. Only one hole has so far tested this zone, but it could be significant as it occurs higher up in the ribbon than the McDermott reef, which potentially opens up more targets within the D4 ribbon, and it is close to existing infrastructure.

The geological database is continually being enhanced as more drill information is collected (drilling of 27,974 m was completed in calendar 2005). Work completed this quarter showed that geological units can be traced over kilometres of strike and the location of stratigraphy and structure is becoming quite predictive; which should continue to improve the accuracy and cost of drill targeting.

Drilling to the south of Greater Garrard reef in the S3 ribbon intersected strong alteration but no significant gold mineralisation (see page 6: Sheepshead line). In addition, results from the D5 ribbon continue to show encouragement without defining a mineable target.

Sheepshead line

S3 ribbon

Drilling 600 m south of known mineralisation was completed this quarter. Strong alteration but no significant new zones of mineralisation were outlined to the south. The ribbon remains untested north of the current underground workings. Four gold-bearing reefs are currently identified:

- Upper S3 reef: reef length is 670 m.

- Christine reef: reef length is 225 m.

- Greater Garrard reef: Reserves are currently defined over 450 m. The reef remains open to the north. Further infill drilling to the north is awaiting the northerly development of the Swan decline. Drilling to the south did not discover any reef extensions.

- Cahill reef: No drilling.

S4 ribbon

- Alexandria reef: reef length 900 m. It remains open to the north and south. Drilling this quarter was focussed on continuing the southerly drill sections while awaiting better drill platform in the north. Results were generally subdued and included 6 m at 15.7 g/t gold, 7 m at 2.6 g/t gold, 4 m at 5.0 g/t gold and 4 m at 4.3 g/t gold.

Further step-out drill sections to the south will be completed in the March quarter. The start of step-out drilling to the north is planned to commence by the June quarter.

Deborah line

D3 ribbon

Shywolup reef: reef length is 600 m. On-reef development activity is underway; see operations commentary. D4 ribbon McDermott reef: reef defined over 400 metres. A 400 m step-out to the south of the McDermott reef returned 7 m at 9.5 g/t gold and 6 m at 5.4 g/t gold.

Although the McDermott reef is expected to be relatively high grade it is not expected at this stage to offer significant tonnage potential.

Due to a once-off availability of drill platform in the north, it was decide to implement a large drill step-out of 800 m to the north. Drilling intersected low grades in the target location, but a new zone, higher up in the stratigraphy was intersected.

The new zone is defined by a single 10 m intersection (6 metres estimated true width) containing visible gold, arsenopyrite, sphalerite and galena (assays pending). The result is exciting as the amount of visible gold indicates strong mineralisation and it is located close to existing infrastructure. Follow-up drilling will commence in the March quarter.

D5 ribbon

Drilling has now been completed over 500 m of strike. A number of good intersections were returned, including 8 m at 17.1 g/t gold, 13 m at 9.7 g/t gold, 6 m at 9.2 g/t gold, 3 m at 5.6 g/t gold, 4 m at 15 g/t gold, 6 m at 4.9 g/t gold and 2 m at 5.3 g/t gold.

Mineralisation is associated with a strongly ruptured anticline axis; however there is insufficient drilling to define a coherent reef shape. Exploration remains focused on defining areas of broader reef development to the north and south.

CORPORATE

The Company announced on 5 October 2005 its intention to raise $140 million equity by way of a pro- rata 3 for 5 entitlement issue at $0.80 per share and an accompanying placement. On 8 November, the Company announced that the entire raising was successfully completed, raising a net $132.5 million.

At 31 December the Company held cash in bank of $179 million (net of creditors available cash is estimated at $158 million).

Jardine Fleming Capital Partners, a local institutional investor, entered the register at the time of the capital raising and has progressively built its holding to 8%.

General Oriental Investments, associated with interests of the late Sir James Goldsmith, was diluted during the raising to less than 5%.