QUARTERLY REPORT July – September 2006

QUARTERLY REPORT July – September 2006

Key Points

- Plant commissioned

- Gold recovery exceeding plan

- Mine development rates up 40%

Summary

Outlook

- Production of 50,000 oz planned for 2006/07.

- Gold grade is budgeted to average 7 g/t gold, but will vary on a monthly basis.

- The immediate focus is on growing the Kangaroo Flat Mine, as such, the development of the Eaglehawk Mine will be slowed by up to 12 months.

- The Company is assessing a variety of funding alternatives in the short and longer term to counter the impact of cost inflation experienced in 2005/6 and the loss of gold production this financial year.

Production

- Commissioning successfully completed late in quarter, with 2,161 oz of gold recovered from processing low-grade material.

- Early gravity gold recovery of 74% is better than plan (total recovery with flotation and leaching of up to 95% is planned).

- Commercial production declared on 1 October 2006.

- Low gold grades experienced in October as mine moves from low-grade stockwork to higher-grade reef.

Mining

- Mine development rates increased 42% this quarter to 1.75 km.

- Ventilation upgrades continue with successful Deborah vent shaft installation.

Exploration

- Information gained from mine development in the quarter has greatly improved the understanding of gold mineralisation; potentially making future exploration more cost-effective but it reduced the tonnage of initial reserves.

- High-priority Railway reef (S4) extended to the north.

- Discovery of Westcott reef (S3) close to existing development.

- Initial development into McDermott reef (D4) is exposing significant quartz with visible gold.

Corporate

- Cash in bank of $58 million at 30 September 2006; creditors of $18 million.

- Revised capital expenditure, excluding exploration of approximately $10 million, for 2006/07 is approximately $75 million with $38 million spent in the September quarter.

DEVELOPMENT STRATEGY

The project is being developed in two phases as the mineralised system is at least 10 km long. The plan is to access the orebody from the southern and northern extremities of the field, with decline ramp access and a dedicated process plant at each end of the field. Mining is planned to occur over the full length of the mineralised system from depths of approximately 750 m to 1,500 m.

Subject to the ongoing rate of success in delineating mineable reefs, the strategy to develop the Bendigo Project consists of:

- Expanding Kangaroo Flat Mine production to design rates of around 200,000 oz/y after three years.

- Initiate Eaglehawk Mine production at around 400,000 oz/y after 2011/12.

- Install necessary infrastructure to support these goals; mainly ventilation shafts and dewatering infrastructure.

Once fully developed, the project is planned to produce over 600,000 oz/y gold.

KANGAROO FLAT MINE

Outlook

Commencement of commercial production was declared after the end of the quarter on 1 October 2006.

The recently announced shortfall in the ore reserve tonnage (ASX release dated 9 October 2006, updated on the 19 October, and discussed in the Exploration section of this report) has caused a rescheduling of the near term mine plan. The tonnage reduction on three of the nine reefs identified to date will limit ore production from 1 October 2006 to June 2007 to around 250,000 tonnes, although every effort will be made to maximise this figure. The plan for 2007/08 is currently to process some 350,000 tonnes, dependent on exploration success.

Gold production in 2006/07 is expected to be 50,000 oz at a grade of around 7 g/t gold, but with variability of +/- 25% on a monthly basis. Gold grades in 2007/08 are currently budgeted at a conservative 7 g/t gold.

Data from historical production highlight the trend of increasing gold grades to the north, which is the basis of the planned average life of mine grade of around 12 g/t gold.

After around six months of commercial production, better estimates on grade will be available and planning should become more predictable.

Total mine operating costs, per tonne of ore treated, are planned to be around $120/t over the next two years.

Mining

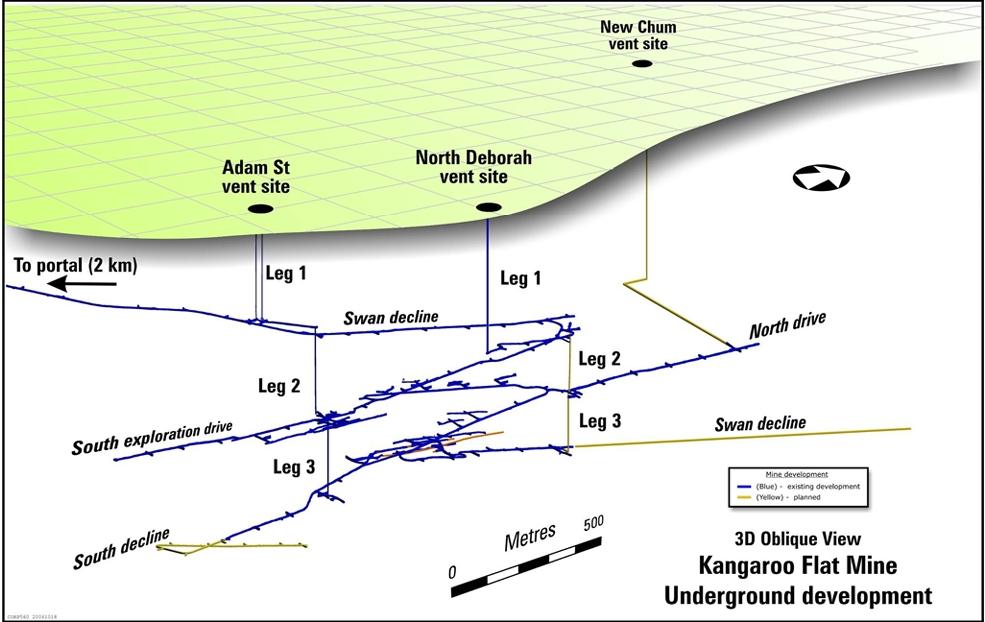

Mine Development

Underground development of 1,751 m was a 42% increase on that achieved in the previous quarter (1,233 m in the June quarter and 1,119 m in the March quarter). Development rates budgeted for the remainder of 2006/07 vary from 1,750-1,950 m per quarter. Development rates required in 2007/08 are planned to increase during the year to 2,500 m per quarter. Additional equipment required to meet these goals has been budgeted.

Development priority was given to the continued extension of the north drive which is required for exploration drill locations and ultimately for a link to the Eaglehawk Mine. The north drive, at a depth of some 760 m, advanced 147 m in the quarter and is now 751 m north of the main Swan decline infrastructure.

Ore Mined

Mining during the quarter was predominantly of low-grade material from development adjacent to the Shywolup (D3), Greater Garrard (S3) and Upper S3 (S3) reefs. Cut and fill stoping in the Shywolup reef and the Upper S3 reef, and bench stoping in the Greater Garrard reef has commenced.

It will take time for the mine to effectively shift development away from low-grade stockworks to higher-grade reef. Ore grades in October will be influenced by the low grade stockworks, with higher grades anticipated during the remainder of the December quarter.

The McDermott reef (not contained in previously quoted reserves) was accessed during the quarter and strike driving on this small, strongly-mineralised reef is planned for the December quarter.

The Company took delivery of a fourth jumbo drill and loader, to increase the mining fleet to 4 x 50 t trucks, 4 jumbos, 4 x loaders plus ancillary support equipment.

Processing

Construction and commissioning of the 600,000 t/y gold process plant was completed during the quarter. Throughput rates have been satisfactory during commissioning and will be further optimised with modifications to the materials handling circuits.

During commissioning, plant feed was low-grade material from development activities which produced 2,161 oz of gold. An excellent gravity gold recovery of 74% was achieved from this material. The flotation and leaching circuit, commissioned after the quarter, is planned to increase total gold recovery to 95%.

Plant design has proven to be excellent in reducing plant noise to below targeted levels. This removes the risk of future constraints on the operation from noise.

Infrastructure

Ventilation

North Deborah

Knowledge gained from the installation of the Adam St vent rise earlier this year has been applied to the North Deborah rise. As such, reaming of the 440 m long Leg 1 of the North Deborah ventilation shaft was successfully completed to plan. Drilling of the pilotholes and reaming of the underground North Deborah Legs 2 and 3 is planned for the December quarter.

New Chum

Planning permission is in place for the New Chum ventilation shaft. Underground development of the 700 m cross-cut has commenced to access the base of the planned rise (see diagram on Page 8 for details).

Dewatering

Dewatering of the historic mine workings is an important element of the Bendigo project. Dewatering currently occurs at a rate of around 3 million litres per day, with plans in place to have capacity to dewater some 8 million litres per day in early 2007.

To support the increase in dewatering, the construction of a $4.6 million water treatment plant at the Company’s New Moon site is due for completion in early 2007.

The majority of the 5 million litres per day of treated water from New Moon is planned to be sent to Coliban Water’s Epsom Treatment Plant for beneficial re-use by the community (Coliban Water is the regional water authority). The Company is working with Coliban Water and government to share the cost of installing the required 6.8 km pipeline. The pipeline project is at the final planning and permitting stage.

EAGLEHAWK MINE

Outlook

The establishment of the Eaglehawk Mine has several steps:

- Dewater old workings following the establishment of pumping and water treatment capacity.

- Develop the main “spine” of the mine by driving a decline and tunnel south from Eaglehawk to connect with the Kangaroo Flat Mine. This work has the major approvals in place and will commence once a stable production base has been established at Kangaroo Flat.

- Exploration and mine development from the Kangaroo Flat Mine, and later from the Eaglehawk decline, to establish sufficient reefs and working faces to support Eaglehawk production at 400,000 oz/y.

- A definitive design and cost study for construction of the Eaglehawk processing plant and infrastructure in around 2009/10.

- Construction of the Eaglehawk plant in around 2010/11.

Timing

Planning permission was confirmed for the Eaglehawk Mine during the quarter.

It has been decided to slow the development of the northern Eaglehawk Mine for up to 12 months, until near-term gold production at Kangaroo Flat has been initiated and stabilised. Completion of infrastructure projects, such as the box cut for the decline portal and noise bund construction, will be considered to enable the rapid acceleration of development when required.

Previous planning had the Eaglehawk Mine commencing production in 2011/12. The slow-down in development for up to 12 months may affect the production start date, but the date remains more dependent on the rate of exploration success and underground development over the next five years.

EXPLORATION

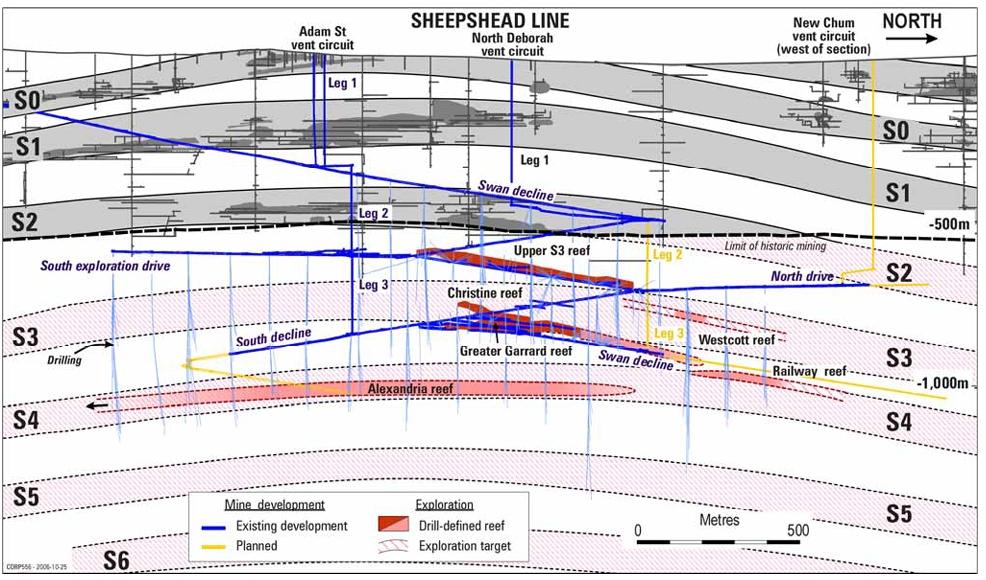

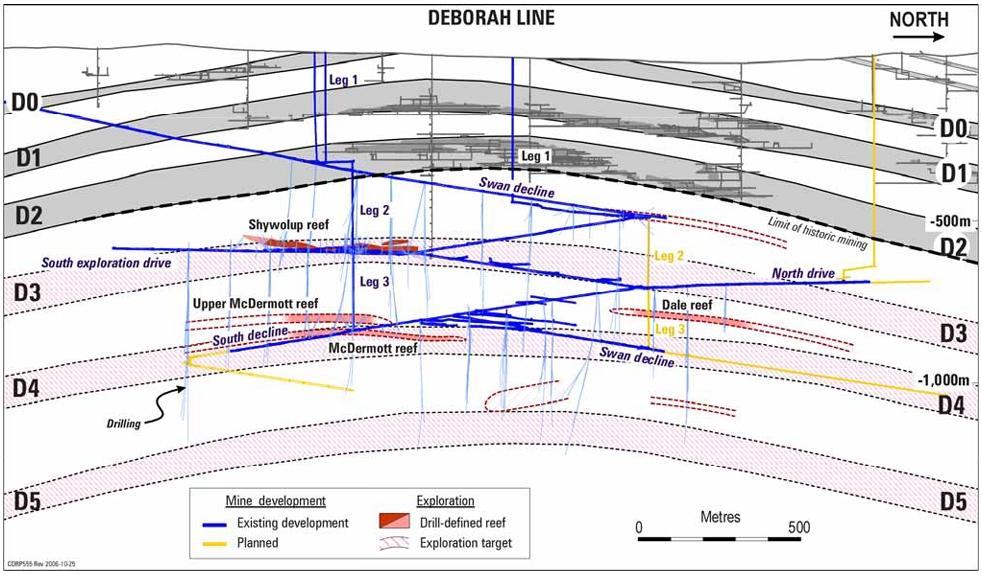

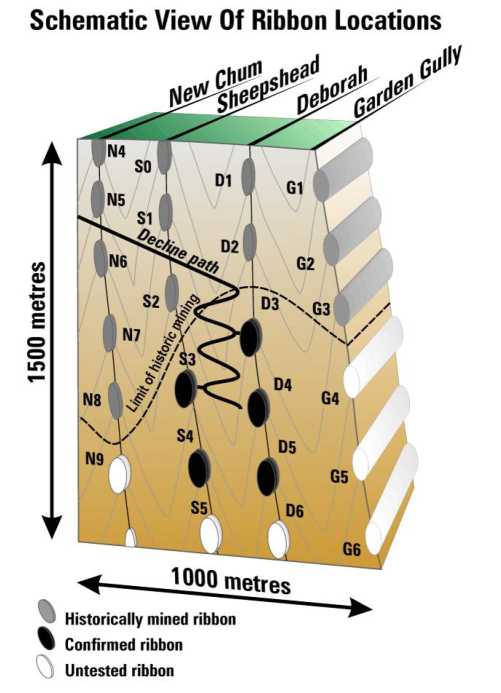

The 11 million ounce Inferred Resource at Bendigo is supported by the highly repetitive nature of gold mineralisation in the field. Historical mining on the major lines of reef and drilling by the Company have shown that gold-bearing reefs repeat vertically every 200-250 metres. Recent drilling on the Deborah and Sheepshead lines has reinforced the predictability of reef positions and the reliability of the geological model (see attached diagrams showing stacked ribbons on pages 6 and 7).

Nine reefs have been discovered to date from drilling, four of which were contained in the Company’s Probable Ore Reserve as quoted in the 2006 Annual Report. Several other drill targets have been identified with more work planned (see Long Sections pages 6 and 7).

Reserve Adjustment

The reduction in reserves, as announced to the ASX on 9 October 2006 and detailed in a follow-up release on 19 October 2006, was a result of the removal of low-grade stockwork mineralisation from the resource envelope. The review of reserves is ongoing and a definitive re-estimate is not expected for several months, however the reduction of tonnage in three of the four reefs contained in the previous reserve has caused a material reduction in the total Probable Ore Reserve.

Information gained from mine development in the quarter has greatly improved the understanding of gold mineralisation; potentially making future exploration more cost-effective.

The reliability of the 11 Moz Inferred Resource is unchanged by the initial mining results and the reduction in reserves. The Inferred Resource estimate is based on actual historical production, whereas the Probable Ore Reserve was a best estimate based on drilling and bulk-sampling. The material now excluded from reserves would never have been extracted by the historic miners and hence such material would not have appeared in the historical production records.

Current Activity

Drilling of 13,785 m of diamond core was completed. This work discovered a new reef, named the Westcott reef (S3) and improved the definition of the Upper McDermott reef (D4). Extensions were made to the Railway reef (S4) and the Dale reef (D4). The size potential of the Railway reef makes it the highest priority target. The McDermott reef was defined to a point where mining is planned to commence in the December 2006 quarter.

Sheepshead Line

Greater Garrard (S3)

Reserve drilling of the northern extension of the Greater Garrard reef commenced during the quarter. Information from mining within the southern portion of Greater Garrard is being applied to the interpretation of infill drilling; with a greater focus applied to the broader zones of quartz mineralisation.

Westcott reef (S3)

A new reef was discovered, associated with folding and faulting, north from the Upper S3 reef. Dimensions are small but significant volumes of quartz and visible gold indicate good potential. The reef is at a similar depth to the Dale reef on the Deborah line of mineralisation.

Railway reef (S4)

Drilling from section SPND04 (Long section page 6) has extended the Railway reef in a northerly direction by 120 m. The reef is now defined over 200 m. A number of holes which intersected the reef contain significant quartz, abundant arsenopyrite and traces of other metals that show strong association with gold mineralisation. The reef is approximately 40 m in height. This target will continue to be progressively drill-tested from the north drive.

Alexandria (S4)

Infilling drilling will commence when the South Decline progresses to a suitable point for drill access.

Deborah Line.

McDermott (D4)

This small reef has been defined over 400 metres from five drill sections, and remains open to the south. Enough information was gathered to design a cross-cut to gain access to the central portion of the reef. Development shows a well developed saddle reef with visible gold mineralisation. Mining is planned to commence next quarter.

Upper McDermott (D4)

Upper McDermott was discovered whilst drilling for the faulted extensions of the McDermott reef. The small reef has returned some significant gold assays from a 2-3 m wide, 15 m high zone of strong stockwork mineralisation.

Dale Reef (D4)

Drilling 120 m north of previous drilling confirmed the northerly extension of the reef. The small high-grade saddle reef, high in the D4 ribbon, has been identified over 250 m and remains open.

CORPORATE

At 30 September the Company held cash in bank of $58 million with creditors of $18 million.

Approximately half of the capital expenditure planned for 2006/07 was incurred in the September 2006 quarter. Cash expenditure rates through 2006/07 are planned to reduce in subsequent quarters.

Kangaroo Flat Mine Capital

Australian underground development and mining costs have increased by about 30% during the past two years.

Development capital planned in 2006/07 for the continued expansion of the Kangaroo Flat Mine is estimated at $50 million. An additional $25 million will be incurred, due to the carry over of costs from 2005/06 as a result of cost inflation at the Kangaroo Flat plant and deferral of some projects into the current year, notably the water treatment plant.

Development capital for 2007/08 is planned at $55 million. Considering the uncertainty on future costs, it is unrealistic to forecast current cost experience beyond two years.

Eaglehawk Mine Capital

The cost of new mining projects has increased by around 30% over the past two years. This rate was similar to that experienced during construction of the Kangaroo Flat Process plant and underground infrastructure.

The previous capital estimate of plant and underground development of $247 million for the Eaglehawk Mine is likely to vary due to the inherent uncertainty over future cost inflation and likely scope changes, as experience is gained at Kangaroo Flat. It is not possible to provide current guidance on the cost of the Eaglehawk Mine until a definitive design and cost study for the Eaglehawk plant is completed in around 2009/10.

To avoid delays to the initiation of Eaglehawk production, supporting capital investments such as dewatering, ventilation, decline tunnel, and exploration and access development will be conducted. Planned investment for the initiation of the Eaglehawk Mine in 2007/08 is estimated at $15 million.

The detailed design for Eaglehawk could be positively altered by ongoing exploration success and the continued expansion of the Kangaroo Flat Mine to full capacity; including any scope for increasing production beyond the 200,000 oz/y rate. In addition, operating experience gained from Kangaroo Flat could influence the design criteria for the Eaglehawk plant, primarily through simplifying the process circuit.

Total Capital investment

Total capital expenditure in 2006/07 is currently estimated at $75 million, with total capital in the subsequent year estimated at $70 million.

A further $10 million per year is planned to be invested in exploration to expand reserves and build flexibility into the mine plan.

Funding strategy

The funding of the Bendigo Project relies on the reinvestment of cashflow derived from the Kangaroo Flat Mine and the investment of cash on hand. The 2005 equity issue, which raised a net $133 million, was intended to enable the project to be funded through to 2010, at which time debt could be accessed to fund the remaining capital. This general funding plan for a reliance on equity pre 2010 and debt post 2010 remains.

Due to significant cost inflation experienced in 2005/06, together with a loss of gold production this financial year, available cash to fund the development is lower than previously estimated. At the time of the October 2005 capital raising, the Company had forecast its cash reserves (net of creditors) at 30 September 2006 to be approximately $75 million versus its actual cash reserves as at 30 September 2006 of $40 million (net of creditors).

The quantum of further funding required before the Company can rely on debt markets will depend on the performance of Kangaroo Flat, particularly future gold grades, future gold prices and future cost inflation.

The current plan is to ensure sufficient funds are available in the short term to enable the Company to prove operating performance at the Kangaroo Flat Mine and increase reserves and mine flexibility. The Company is currently assessing a variety of funding alternatives.

The attractiveness of longer term funding options available to the Company will increase after a track record of production and positive exploration is delivered.