QUARTERLY REPORT October – December 2001

Quarterly Report October – December 2001

Highlights

- Drill testing confirms 180 metre strike continuity of high grade reef in D3 ribbon.

- Decline development recommenced in late December 2001.

- Shareholders approved the placement of 294.1 million shares to Harmony Gold Mining Company Limited to raise $50 million.

In this document, the term “resource potential” is used to describe the Company’s estimate of the contained ounces of gold which it believes, on the basis of a technical evaluation of available data and geological extrapolation, should occur within the New Bendigo. It is emphasised that this term is not covered by the JORC Code and is not equivalent to a Mineral Resource or Ore Reserve estimate.

The information in this report that relates to Mineral Resources or Ore Reserves is based on, and accurately reflects, information compiled by G F Johansen, Member of the Australian Institute of Mining and Metallurgy. Mr Johansen is a full-time employee of the Company and has relevant experience in relation to the mineralisation being reported to qualify as a Competent Person as defined in the Australian Code for Reporting of Mineral Resources and Ore Reserves. Mr Johansen consents to the inclusion in the report of the matters based on the information in the form and context in which it appears.

EXPLORATION

Drill testing confirmed the strike continuity for 180 meters of a high-grade reef in the D3 ribbon. Results of drilling on sections SP17 and SP18S have provided reef intersections of 1m at 710g/t Au and 2.05m at 160.5 g/t Au respectively, some 120 meters apart. Drilling was recently completed on section SP18, 40 meters north of SP18S, to test for strike continuity of the reef. An intersection of 6.5m of reef with coarse visible gold was made. The assays are still awaited.

Although a declaration of grade based on the drill hole intersections cannot be made at this time, due to the coarse nuggetty distribution of the gold, it is apparent that a high-grade reef of at least 180 meters strike length exists in the D3 ribbon.

The assay results of drilling from SP24 into the S3 reefs, as previously reported in the September quarterly report, are now available and returned intersections of 3m at 28g/t Au and 3m at 3.5g/t Au. These intersections are 120 metres further north than any previous drilling and the mineralisation remains open to the north.

UNDERGROUND DEVELOPMENT PLANS

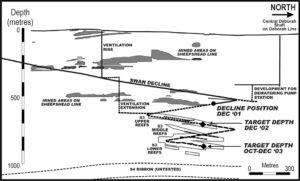

The Company’s plans to commence production in late 2003 got underway with the recommencement of the Swan Decline development on 21 December 2001.

Over the next 12 months the aim is to advance the decline by 1 kilometre and put in place supporting infrastructure for the primary ventilation and dewatering systems.

By December 2002 it is expected that the decline will have been extended from its present depth of 550 meters to 700 meters below surface and at that time access into the uppermost gold bearing reef of the S3 ribbon will be established. A two-month program of on-reef exploration development and bulk sampling is planned to be undertaken in parallel with ongoing decline development towards the deeper reefs.

During 2003 the Company plans to extend the decline to 800 meters below surface. This will allow some five gold bearing reefs to be explored and bulk sampled to establish a Reserve and Resource base for production which is targeted to commence in late 2003.

Milestones

- December 2001 Decline currently 3,500 metres

- March 2002 Decline at 3,800 metres

- June 2002 Decline at 4,000 metres

- September 2002 Decline at 4,200 metres

- December 2002 Decline at 4,500 metres, 700 metres below surface Access S3 upper reef

- December 2003 Decline at 5,300 metres, 800 metres below surface Access S3 middle and lower reefs

FUNDING

Following shareholder approval at the Annual General Meeting on 13 December 2001, $50 million was raised by placement of 294.1 million shares at 17 cents each to Harmony Gold Mining Company Limited (“Harmony”). Shareholders also approved the granting of 360 million options to Harmony to acquire shares in Bendigo Mining at 30 cents per share at any time before 31 December 2003. The new equity capital will be employed by Bendigo Mining to continue development of the New Bendigo Gold Project, with the aim of taking it into production.

The convertible notes issued to UniSuper in April 2001 matured in December 2001 and, pursuant to the terms of the Convertible Note Deed, 47.6 million shares were issued to UniSuper at 13.8 cents per share in redemption of the 6 million convertible notes plus interest.

Following the abovementioned share transactions Harmony holds 31.8% of Bendigo Mining and UniSuper 13.5%. Should Harmony exercise all its options it will inject a further $108 million into Bendigo Mining and hold approximately 50.9% of Bendigo Mining’s undiluted share capital.

GENERAL MEETING 18 FEBRUARY 2002

A notice of meeting and explanatory memorandum has been sent to shareholders for a general meeting to be held on 18 February 2002. At the meeting shareholders will be asked to approve the issue of up to 12.5 million options under the Bendigo Mining Share Option Plan 2002 which includes the issue of 5 million options to a company controlled by Mr T P Philip and 2.3 million options to a company controlled by Mr A D Buerger. The options’ exercise price of 30 cents each and expiry date of 31 December 2003 match that of the options issued to Harmony.

Statement of Financial Performance For the quarter ended 31 December 2001 (Unaudited) $A’000

Operating Expenditure 2,503

Less: Interest Received and Other Income (231)

Operating Loss 2,272

Income Tax Attributable 0

Operating Loss After Income Tax 2,272

Accumulated Losses 30/09/01 65,149

Accumulated Losses 31/12/01 67,421

Statement of Financial Position As at 31 December 2001 (Unaudited) $A’000

CURRENT ASSETS

Cash & Investments 52,339

Other Current Assets 1,347

TOTAL CURRENT ASSETS 53,686

NON CURRENT ASSETS

Property, Plant and Equipment 2,357

TOTAL NON CURRENT ASSETS 2,357

TOTAL ASSETS 56,043

CURRENT LIABILITIES

Accounts Payable 1,209

Provisions 175

TOTAL CURRENT LIABILITIES 1,384

NON CURRENT LIABILITIES

Provisions 27

TOTAL NON CURRENT LIABILITIES 27

TOTAL LIABILITIES 1,411

NET ASSETS 54,632

SHAREHOLDERS’ EQUITY

Share Capital 122,053 Accumulated Losses (67,421)

TOTAL SHAREHOLDERS’ EQUITY 54,632