Quarterly Report October – December 2006

QUARTERLY REPORT July – September 2006

Key Points

- Company to change strategy: production to be deferred, immediate focus on building reserves through exploration.

- A 2 million ounce exploration target available for drill testing over the next 18 months.

- Project expansion will be postponed during this period.

- The new strategy will be funded from the Company’s current cash in bank.

- Senior management changes

Change in Strategic Direction

With the reconciliation of the December quarter production results, it is now apparent that a general overestimate of the potential of the Sheepshead and Deborah Lines has been made. The significantly lower than expected production results warrant a major shift in strategy. This change will result in the deferral of production and a focus on building reserves in more productive areas in the south of the goldfield. The goal is to deliver reliable production of 150-200,000 ounces a year from the Kangaroo Flat Mine.

The Company remains confident of the rich endowment of the Bendigo system and its ability to support high rates of production. However, the initial strategy of relying on two historically less productive lines of mineralisation to support a growth strategy, in Sheepshead and Deborah, has proven to be high risk and unsustainable.

The interpretational errors that caused the overestimate of potential is disappointing, particularly as an extensive amount of quality data was collected from diamond drilling and bulk-sampling in an attempt to reduce risk prior to committing to production. The recent reserve review in October 2006 also proved to be inaccurate.

Other significant changes include the resignation of the Managing Director & CEO Mr Doug Buerger, the appointment of Rod Hanson as Managing Director and CEO, and other senior executive changes.

Due to the change in strategy, a major write down in the value of the Company’s non current assets, in the order of $90 to $210 million subject to audit opinion, is required and will generate a significant loss this financial year.

Summary

Outlook

- The revised strategy will involve a break in production whilst exploration is undertaken from underground drill locations to test some of the most historically rich areas of the Bendigo Goldfield.

- The Company is in a strong position to rebuild value over the next 18 months, with a process plant, mine equipment and underground mine access to explore, and then exploit successful future discoveries.

Summary cont…

Production

- Production during November and December achieved a grade of 4.7 g/t gold, with the full quarter generating production of 9,218 ounces at a grade of 4.1 g/t gold. These results are significantly below expectations.

- Plant performance was satisfactory with total gold recovery of 90% on the lower head grade. Cash operating cost of A$124/t of ore treated was within forecast levels.

Exploration

- The revised exploration strategy is planned to test a 2 million ounce Inferred Resource target to a depth of 1,200 m on three lines of mineralisation.

- The programme will commence immediately, and within six months drilling is planned to test regions beneath historic mines that produced 500,000 oz at a grade of 23 g/t gold.

Management

- Managing Director & CEO Mr Doug Buerger has announced his resignation for personal and health reasons. Mr Rod Hanson, Chief Operating Officer, has been appointed Managing Director and CEO. Other senior executive changes have been implemented.

Corporate

- Available cash as at 31 December 2006 was $66 million, which will be utilised to fund the new strategy for 18 months to June 2008.

- A write down in the value of the Company’s non current assets, in the order of $90 to $210 million subject to audit opinion, is required and will generate a significant loss this financial year.

DEVELOPMENT STRATEGY

Results from the initial three months of production indicate that a major shift in strategy is warranted.

Bendigo Mining’s goal is to deliver a reliable and growing base of gold production. The Board remains confident in the rich endowment of the Bendigo Goldfield and its ability to support high rates of production. However, a shift in strategy is required to build reserves in more productive areas in the south of the goldfield, with the goal of delivering reliable production of 150-200,000 ounces a year from the Kangaroo Flat Mine.

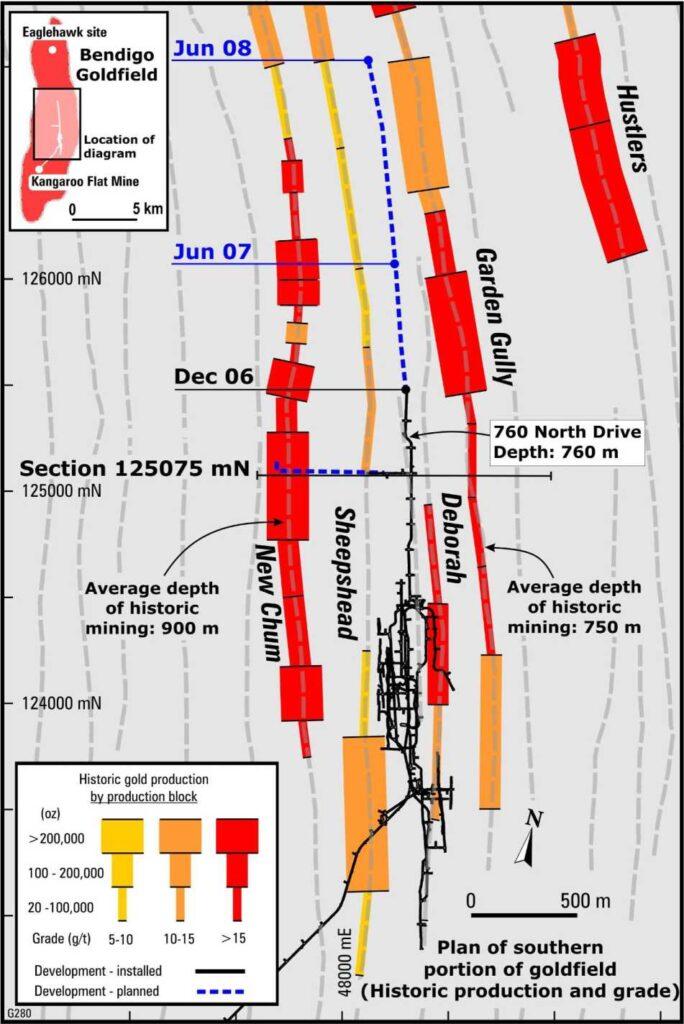

The exploration programme will target some 2 million ounces of Inferred Resources down to a depth of around 1,200 m on the Garden Gully, New Chum and North Sheepshead Lines. Garden Gully and New Chum accounted for some 70% of historic gold production and are the key exploration targets. The revised strategy will involve a break in production, the duration of which will depend on exploration success but could range from several months, if drilling at North Sheepshead is successful, to beyond two years, if drilling at Garden Gully is successful.

The revised strategy

- Create a leaner, exploration-driven organisation and culture.

- Cease all non-critical capital expenditure. The dewatering programme will continue so as to sustain future options for exploration and mining.

- Pause commercial production in the first half of 2007 once the accessed reefs have been mined to their economic limits. Production to recommence when reserves are sufficient to support consistent gold output.

- Cease all access development to unmined reefs on the Deborah and South Sheepshead Lines until better grade information from current production and additional exploration drilling is available.

- Continue to develop the main underground access drive northwards to provide drill locations (760 North Drive).

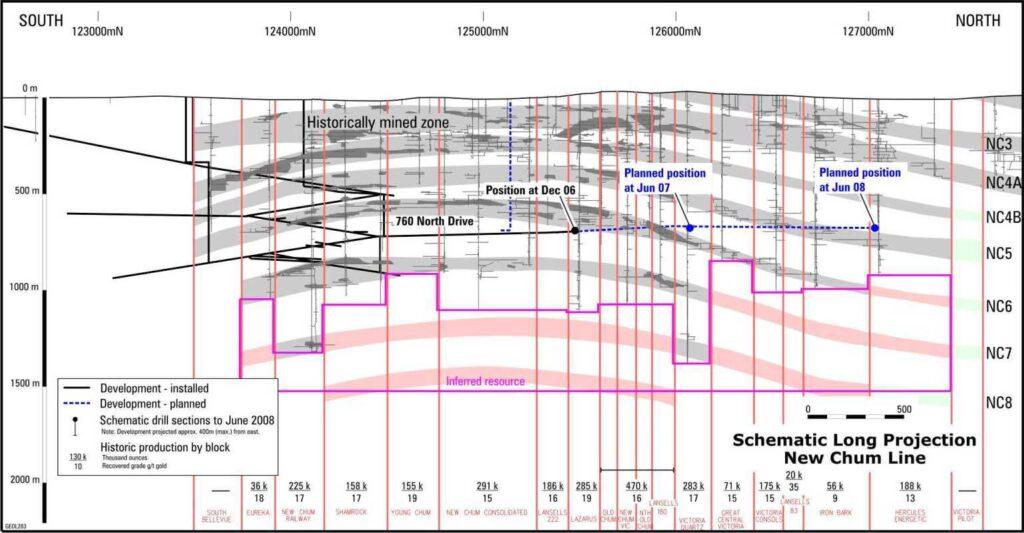

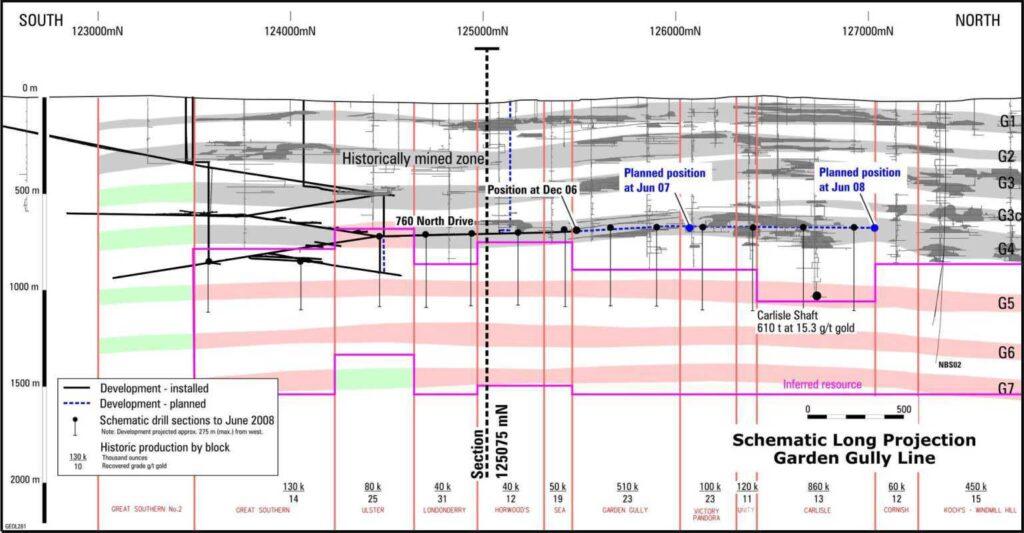

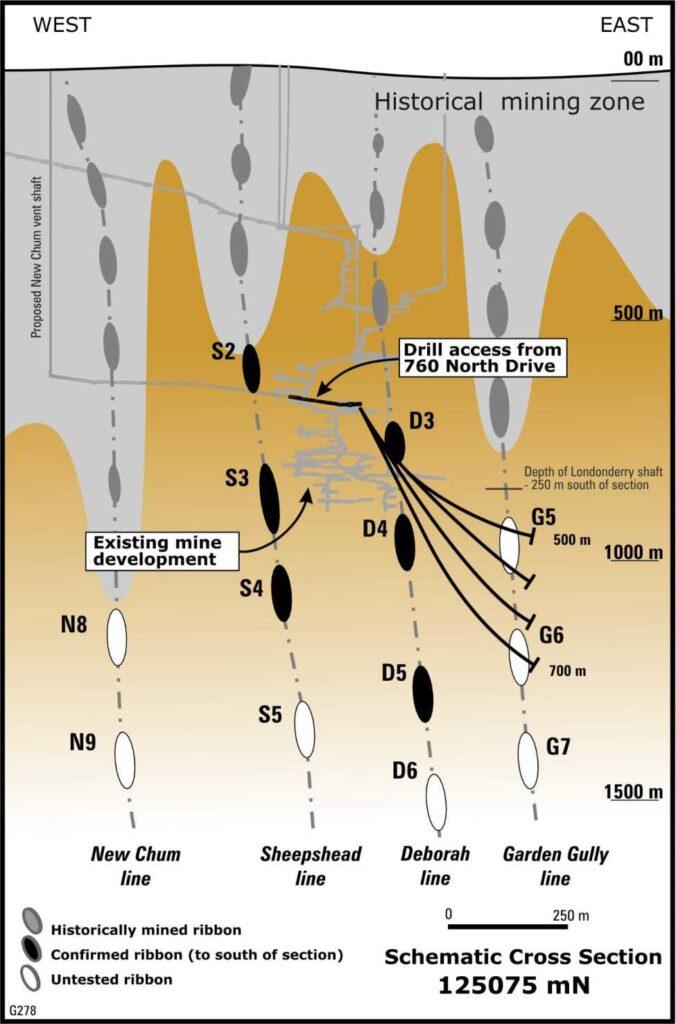

The 760 North Drive provides an excellent platform to test beneath the historic workings on parallel lines of mineralisation. As development progresses over the next 18 months to June 2008, almost the entire southern half of the Bendigo Goldfield will become available for drill-testing.

These targets are 300 m east of the Kangaroo Flat Mine, where a 3.5 km section of the Garden Gully Line produced 2 million ounces at a recovered grade of 15 g/t gold, and 500 m west, where a 3 km long section of the New Chum Line produced 2.3 million ounces at a recovered grade of 16 g/t gold.

Within these lines there were some bonanza mines, such as the Garden Gully United Mine on Garden Gully which produced some 500,000 ounces at a recovered grade of 23 g/t gold (Page 8) and the Lazarus Mine on New Chum which produced 285,000 oz at a recovered grade of 19 g/t gold. These are some of the most historically rich areas of the Bendigo Goldfield and areas beneath these historic mines will be available for drill-testing over the next 18 months.

Despite recent disappointment in resource estimation, the Company believes it is now in a stronger position to identify viable reefs. This is already underway, with the downgrading of the immediate potential of Alexandria and Railway reefs on the basis of a stricter interpretation of geology and drill assay data. The development of all recently discovered reefs have been put on hold pending a re-interpretation of grades and geology.

The capital cost of the revised strategy is estimated at $10 million in exploration and $25 million in mine development and site costs a year. The Company’s available cash of $66 million is planned to fund the proposed programme to June 2008.

All operating approvals are in place along with significant installed infrastructure, including mine access to a depth of about 900 m and a fully commissioned 600,000 t/y gold plant. These assets can be utilised to restart commercial production when supported by sufficient reserves.

PRODUCTION

Outlook

The reefs on the South Sheepshead and Deborah Lines of mineralisation have delivered below budget grades and tonnes. The Board considers that continuing with commercial production with limited reserves in a weakly endowed area is high risk and unsustainable. Mining of accessed reefs should be completed within the first half of 2007. No production forecasts can be made for this period.

Safety

There were no lost time injuries (LTI’s) in the quarter, relative to three LTI’s in the September 2006 quarter. The medically referred injury frequency rate (MRIFR – the sum of lost time plus medically treated injuries per million man hours) is a key safety performance indicator. The year-to-date MRIFR at the end of the quarter was 18 compared to a year to date MRIFR at the end of the September 2006 quarter of 24.2. This represents a significant improvement from the MRIFR for 2005/06 year of 37.3.

Ore production

Production during the quarter, excluding the low grade transitional month of October, achieved a grade of 4.7 g/t gold. The full quarter produced 9,218 ounces of gold, as detailed in the table below:

| Production | Oct | Nov | Dec | Dec 06 Qtr | Nov&Dec | |

|---|---|---|---|---|---|---|

| Ore treated | kt | 24 | 27 | 27 | 78 | 54 |

| Gold grade | g/t | 2,7 | 4,9 | 4,6 | 4,1 | 4,7 |

| Gravity recovery | 73% | 77% | 80% | 77% | 78% | |

| Total recovery | 90% | 86% | 95% | 90% | 91% | |

| Gold produced | oz | 1,841 | 3,357 | 3,819 | 9,218 | 7,376 |

The quarterly production performance includes processing of low grade stockwork and development ore during October at a grade of 2.7 g/t gold. November contained a mix of low and high grade and the overall grade improved to 4.9 g/t gold. The higher grade in November was in line with internal forecasts post the October 2006 reserve review.

The grade experienced in December of 4.6 g/t gold was from ore sourced almost exclusively from the cores of Upper S3, Greater Garrard, and Shywolup reefs. Individual reef grades have varied from around 3 g/t to 6 g/t gold. The failure of ore grades to achieve an average of 7 g/t gold in the month of December highlighted some fundamental issues with resource estimation on the Sheepshead and Deborah Lines (see Review of results).

Total operating unit costs of A$124/t achieved predicted levels despite below budget tonnes processed and some increased requirement for ground support during mining and development.

Processing

The process plant achieved high levels of gold recovery and good performance of the gravity gold circuit. A total gold recovery of 90% for the quarter was a good achievement considering the lower grade of ore processed. Some issues associated with fine organic carbon were experienced in the Upper S3 reef in November and resolved with modifying reagents in the leaching circuit in December. Wear rates on the high pressure grinding rolls are above design levels and being closely monitored by the equipment supplier who is firmly supporting the wear rate guarantee.

Review of results

A number of interpretational errors were made which resulted in a local over-estimate of initial reserves on the Sheepshead and Deborah Lines. It was considered in October 2006 that once the low-grade fringe or stockwork mineralisation was removed from the reserve, the remaining core would be a solid mining shape with economic grade. This reserve review has proven to be inaccurate.

The Company, in discussion with independent consultants, has identified several issues which affected resource estimation. One issue relates to an assumption that the relatively simple and laterally continuous geometry of the rocks within the Bendigo field would apply to the local scale of mineralised reefs. This is incorrect in the currently accessed reefs as mining has encountered higher complexity than expected. Secondly, whilst grade transformation is a valid approach in a nuggetty gold environment, the current factor used to estimate gold grades appears to be overestimating the grade of lower grade material. Difficulty in geological control during mining has also been experienced leading to excessive mining dilution (the processing of barren rock). These issues have led to a lower head grade and a significant shortfall in contained gold.

The interpretational errors in estimating resources have been compounded by the fact that mining was located within the historically less productive Sheepshead and Deborah Lines.

Whilst it was known that the Sheepshead and Deborah Lines had historically been below average producers, they were the shallowest reefs available for early modern-day exploitation and the quickest to dewater. Recent experience indicates that these lines cannot now be relied upon to underpin the Company’s growth strategy.

The estimation error is particularly disappointing considering the extensive amount of diamond drilling and bulk-sample data collected in an attempt to reduce risk prior to committing to production. A review of data collected by the Company will be conducted; however it is currently considered that the key error was in the interpretation of the data, rather than the data itself.

MINE DEVELOPMENT

Underground mine development was satisfactory at 1,600 m (1,751 m achieved in the September 2006 quarter). This will reduce over the coming quarters as all non-essential capital development has been paused and the 760 North Drive is now the sole capital development activity.

The opportunity to continue with the Swan and South declines will be dependent on the economic viability of the Alexandria and Railway reefs and on exploration success.

The 760 North Drive, at a depth of 760 m, advanced 264 m in the quarter and is currently 1,015 m north of our main decline infrastructure. By June 2007, the North Drive, including existing decline infrastructure, is planned to cover some 25% of the southern portion of the goldfield. By June 2008, some 40% of the field will be accessible for drilling from the development.

Infrastructure

Dewatering of the historic mine workings is an important safety element of the development strategy. Dewatering is planned to increase from 2 million to 7 million litres per day in early 2007. This is part of the plan to access areas beneath the Garden Gully and New Chum Lines which are currently full of water. The construction of a $4.6 million water treatment plant at the Company’s New Moon site is well advanced and due for completion in February 2007. A pipeline to transport treated water from New Moon to the local water authority, for community reuse, will be constructed in the March 2007 quarter.

EXPLORATION

Inferred Resource

The Company remains confident of the rich endowment of the Bendigo system and its ability to support high rates of production.

• Sheepshead and Deborah Lines

The Sheepshead and Deborah Lines are the least productive lines in the goldfield, having produced less than 10% of total historic gold production. These lines have so far not met Company expectations. The Inferred Resource model predicted around 0.5 million ounces of gold in areas tested by current drilling, whereas drilling has shown around half this amount at a grade mostly around economic cut-off.

One important historical feature of the Sheepshead and Deborah Lines is that each line contained one single ‘bonanza’ mine that produced 60% to 75% of the entire production from the line. If these mines are excluded from each line, the Company’s discovery rate is a reasonable match to the model.

It is well documented that the Bendigo Goldfield produced many bonanza reefs which supported the mining of lower grade reefs. Very high grade orebodies can be located near low grade orebodies without any apparent pattern. The Company has yet to find bonanza reefs on either the Sheepshead or Deborah Lines.

Exploration Strategy

The strategy to build reserves over the next 18 months to June 2008 comprises wide-spaced drilling on the Garden Gully Line over a strike of 3.5 km and wide-spaced drilling over 2 km on the North Sheepshead Line. Timing of New Chum drilling will depend on drill results from Garden Gully. The knowledge gained from recent production and exploration will be rigorously applied in interpreting future exploration results.

The key initial targets are the Garden Gully (some 300 m east of current development) and North Sheepshead Lines (close to existing infrastructure). The attraction of Garden Gully relative to the New Chum Line is a larger resource target and a shallower depth of historic mining (Figure 2). Historic mining occurred to depths of 750 m on Garden Gully, relative to 900 m on New Chum. New Chum remains a valuable target but second in priority to Garden Gully.

The initial target is approximately 2 million ounces of Inferred Resources down to a depth of around 1,200 m. Approximately 1 million ounces of Inferred Resources are available for testing on Garden Gully, with the remainder on the New Chum and North Sheepshead Lines.

The programme will involve four diamond drill rigs in the 760 North Drive, some 760 m below surface. Exploration is planned to commence in January with three drill rigs engaged on Garden Gully and a fourth at North Sheepshead. The programme is budgeted to cost $10 million a year.

- Garden Gully

Over the next 18 months to June 2008, some 3.5 km of the Garden Gully Line, or 40% of its length, will be available for drilling testing (Figure 3). Historical production of 2 million ounces at 15 g/t gold occurred from this zone and an Inferred Resource of 1 million ounces of gold down to a depth of 1,200 m remains to be better defined through drilling.

The southern end of Garden Gully produced high grade but only modest tonnage, however the strong gold mineralisation of the entire Garden Gully Line, combined with the erratic distribution of bonanza reefs, requires the southern end of the line to be systematically explored.

The 760 North Drive development has just entered an area adjacent to and below Garden Gully which contained some exceptionally rich historic mines, such as the Garden Gully United Mine which produced some 500,000 ounces at 23 g/t gold. The unmined area below this mine will be available for drilling testing within six months.

- New Chum

Located 500 m west of the Kangaroo Flat Mine is a 3 km section of the New Chum Line which produced 2.3 million ounces at a grade of 16 g/t gold. Within this section there were numerous bonanza reefs, such as the Lazarus Mine which produced 285,000 oz at 19 g/t gold (Figure 4).

Some 600,000 oz of Inferred Resource is able to be tested below historic workings to a depth of 1,200 m.

- North Sheepshead

The northern section of the Sheepshead Line remains an important target because of its location close to the 760 North Drive infrastructure (Page 10). The line requires adequate testing to ensure no bonanza reefs are overlooked.

CORPORATE

Management

For personal and health reasons, the Managing Director & CEO Mr Doug Buerger has decided to resign and allow the Company to move forward under new stewardship. Mr Rod Hanson, currently Chief Operating Officer, will be appointed Managing Director and CEO with immediate effect. The Board thanks Doug for his efforts in advancing the Bendigo Project over the past decade.

Mr Garry Johansen, General Manager Geology, has ceased employment with the Company. Mr Hanson is taking responsibility for exploration and managing a team of experienced geologists.

Mr Tim Churcher will become Chief Financial Officer in addition to his existing responsibilities for Corporate Development and Investor Relations.

Finance

With cash in bank of $82 million and creditors of $16 million, available cash at the end of December 2006 is $66 million. This is more than adequate to fund the new strategy for the next 18 months.

Due to the change in strategy, a major write down in the value of the Company’s non current assets, in the order of $90 to $210 million subject to audit opinion, is required and will generate a significant loss this financial year.