West African Resources unlocks the potential of the Kiaka gold mine

West African Resources has published the results of a feasibility study for its 90% owned Kiaka gold project in Burkina Faso, foreshadowing a potential open-pit mining operation that could support a processing capacity of 8.4 million tonnes per annum.

Kiaka is 140km southeast of Ouagadougou and 45km south of the company’s existing Sanbrado gold mine.

The mining study at Kiaka is based on traditional open-pit mining methods, with ore from the pit being fed directly into the crushing circuit. Mining operations will use a combination of 140t (Cat 6015) and 230t (Cat 6020) hydraulic excavators and 95t (Cat 777) dumper trucks.

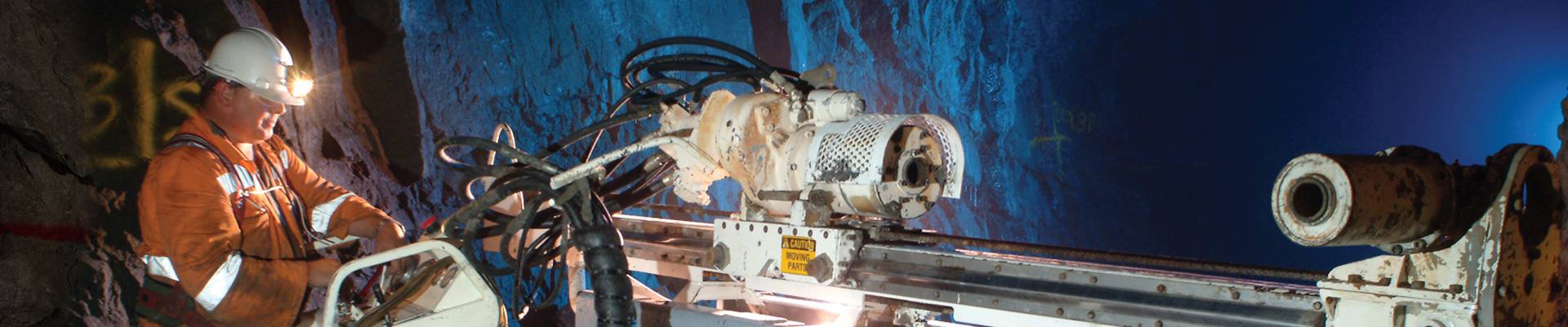

Blasting will be required close to the surface, with parameters selected based on the properties of the relatively hard rock mass and the required selectivity of ore extraction. The Company noted that, given the wide mineralised zone, some blasting will be possible on 10-metre benches and more selective areas will be blasted on 5-metre benches. Thus, a blasting rig consisting of a boring hammer (Sandvik Panterra DP1500) and a down-hole hammer (Sandvik Leopard DI650) will be used.

An average of 21 million tonnes of material per year is required to achieve the target processing speed over the first seven years of the production schedule. Due to the fact that the open pit mine is set aside for waste movement, this increases to an average of 35 million tonnes per year over the next six years of production and then declines to an average of 15 million tonnes per year for the remainder of the mine’s life.

The production profile is suitable for an initial fleet of 2 230-tonne excavators and 1 140-tonne excavator, matching the 95-tonne class trucks. The fleet will increase to 3 230t excavators and 2 140t excavators for higher production requirements. Further work will be undertaken to investigate volumetric mining scenarios and optimise fleet selection, as well as further refinement of drilling parameters in conjunction with fleet optimisation.

The Kiaka free-milling gold ore is designed to be processed using a conventional single-stage gyratory crusher and SABC ball mill grinding cycle, followed by carbon leaching (CIL) processing. Extensive metallurgical testing indicates that Kiaka will provide a life-of-mine gold recovery of 90% at a nominal grinding size of 100 microns.

After reviewing the study options, the company has selected the following key equipment:

- Primary gyratory crusher – Metso Outotec Superior™ MKIII 54-75;

- SAG Mill – 18MW; and

- Ball mill – 9 MW

The crusher can achieve an output of 8.4 million tonnes per annum with an availability factor of 65%. At 70 % utilisation the throughput varies between 9.2 mtpa and 10.2 mtpa for the design mix. The mills selected also have a higher than typical design throughput indicated on the nameplate, with modelling by OMC showing that the selected grinding scheme is capable of delivering throughput:

- 8.4 million tonnes/year (1,050 tph) for 100% fresh ore feed using 80th percentile ore characteristics;

- 9 Mt/yr (1,125 tph) for 100% fresh ore when modelling average (50th percentile) ore characteristics;

- 14 Mtpa (1,750tph) for 100% oxide ore feed; and

- 10 Mtpa (1,250 tph) for mixed feed consisting of 23% oxide and 77% fresh ore.

- On a 100% life-of-mine basis, the mine should produce 219,000 ounces of gold per annum (18.5 years).

West Africa executive chairman and CEO Richard Hyde said: “Kiaka will have access to power from the Burkina Faso grid, predominantly supplied by low-carbon hydro from Ghana and Côte d’Ivoire, with large low-carbon solar projects in Burkina Faso scheduled to start up earlier. in mine life to complement the grid.”

Hyde says WAF will consider expanding Kiaka to plus 10mtpa by adding secondary crushing and removing bottlenecks in the processing circuit, as well as evaluating bids for key capital equipment received during the feasibility study, which varied widely in price and delivery time. times.

“There remains an opportunity to reduce capital costs and contingencies for this equipment, as well as reduce lead times,” Hyde said. West African Resources is also considering an owner versus contractor mining study (current plan) to reduce mining and working capital costs inclusive of VAT.